A) Inventory turnover

B) Price/Earnings ratio

C) Net profit margin

D) Times interest earned

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of ratio indicates a company's ability to generate income in the current period?

A) Profitability ratios

B) Liquidity ratios

C) Solvency ratios

D) Current ratios

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios does not use net income in its calculation?

A) Net profit margin

B) Earnings per share

C) Return on equity

D) Fixed asset turnover

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net income was $753,480 in the current year and $655,200 in the prior year.The year-to-year percentage change in net income is an increase of:

A) 15%.

B) 55%.

C) 87%.

D) 13%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

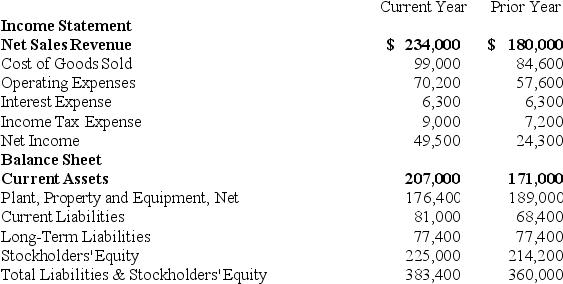

The comparative financial statements of Seward,Inc.include the following data:  The gross profit percentage for the current year is closest to:

The gross profit percentage for the current year is closest to:

A) 42%.

B) 13.5%.

C) 57.7%.

D) 21.15%.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Benchmarks are useful when evaluating a company's performance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ratio that measures the percentage of financing from creditors is the:

A) current ratio.

B) times interest earned ratio.

C) debt-to-assets ratio.

D) Price/Earnings ratio.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wayne,Inc.has net sales revenue of $348,800,cost of goods sold of $274,400,and net income of $2,400.If interest expense is $8,000 and income tax expense is $800,the times interest earned ratio is:

A) 1.4.

B) 0.33.

C) 1.3.

D) 0.40.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which ratio is used to evaluate how well a company is managing its property,plant,and equipment?

A) Receivables turnover

B) Inventory turnover

C) Fixed asset turnover

D) Debt-to-assets ratio

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Solvency ratio data are primarily concerned with the ability of a company to:

A) produce profits.

B) maintain long-term survival and repay its debt.

C) manage its cash flow.

D) provide income for stockholders.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A company with a high inventory turnover requires a larger investment in inventory than another company of similar sales with a lower inventory turnover.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the gross profit percentage indicates that:

A) cost of goods sold as a percentage of sales has decreased.

B) cost of goods sold as a percentage of sales has increased.

C) operating expenses as a percentage of sales have increased.

D) operating expenses as a percentage of sales have decreased.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current accounting period,revenue from credit sales is $536,800.The Accounts Receivable balance is $41,184 at the beginning of the period and $41,760 at the end of the period.Which of the following statements is correct?

A) The receivables turnover ratio is 12.9.

B) On average,it takes 12.9 days to collect payment from credit customers.

C) The receivables turnover ratio is 28.3.

D) On average,the company sells its inventory every 28.3 days.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Trend data can be measured in dollar amounts or percentages.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When evaluating its net profit margin for the current year,Coca Cola would most likely use all of the following benchmarks except:

A) Anheuser Busch's net profit margin.

B) the Fortune 500's net profit margin.

C) Pepsico's net profit margin.

D) the average net profit margin for the soft drink manufacturing industry.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios is used to evaluate how efficient a company is in using its fixed assets to generate revenues?

A) Current ratio

B) Debt-to-assets ratio

C) Return on fixed assets ratio

D) Fixed asset turnover ratio

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures would assist in assessing the profitability of a company?

A) Earnings per share

B) Times interest earned ratio

C) Inventory turnover ratio

D) Debt-to-assets ratio

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lyndale,Inc.'s sales are $513,000 and $360,000 during the current and prior years,respectively.The percentage change is:

A) 42.5%.

B) 70%.

C) 29.8%.

D) 130%.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kingsbury Manufacturing has net sales revenue of $624,000,cost of goods sold of $274,560,and all other expenses of $262,080.The net profit margin is:

A) 0.32.

B) 0.56.

C) 0.86.

D) 0.14.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has a debt-to-assets ratio of 0.45.If the company then borrows cash from the bank to finance a building acquisition,which of the following is a correct statement?

A) The debt-to-assets ratio will be unchanged.

B) The debt-to-assets ratio will increase.

C) The debt-to-assets ratio will decrease.

D) The debt-to-assets ratio will increase as a result of the cash received and then decrease as a result of the building acquisition.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 141

Related Exams