A) The federal government makes the CHT and the CST annually to the provinces,who are legally bound to spend on the funds for their intended purposes.

B) The federal government makes the CHT and CST annually to the provinces,who in turn make transfers to individuals according to need.

C) The federal government makes the CHT and CST annually to the provinces for spending on health and social programs,but the provinces are free to spend the funds as they wish.

D) The CHT and CST are both components of equalization payments from the federal to provincial governments.

E) The CHT and CST are demogrants that are transferred annually from the federal government to individuals residing in regions of Canada that lack adequate access to health and education programs.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

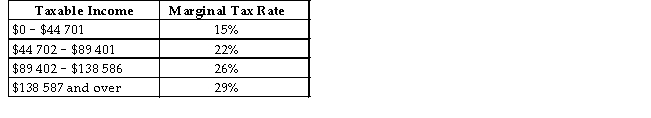

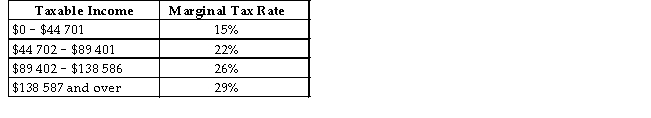

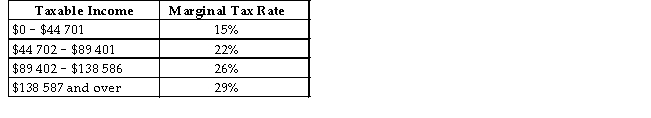

The table below shows 2015 federal income-tax rates in Canada.  TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 26%?

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 26%?

A) $497

B) $5639

C) $8960

D) $7955

E) $31 200

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is a demogrant?

A) A federal transfer to individuals that is administered through the tax system.

B) A federal transfer to provincial governments that is adjusted annually based on demographic shifts in the province.

C) A social benefit that is paid to individuals according to their demographic group (race,age or income group,for example) .

D) A social benefit that is paid to individuals depending on their income.

E) A social benefit that is paid to individuals,regardless of their income.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following areas of spending account for the largest portion of total Canadian government expenditures?

A) equalization payments

B) defence spending

C) subsidies to Canadian businesses

D) social services

E) interest payments on public debt

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider two families,each of whom earn total income of $80 000,but that are different in many other respects,such as the number of individuals to support.If each family is assessed income tax payable of $14 749,then it is very likely that the principle of ________ is being violated.

A) progressivity

B) horizontal equity

C) vertical equity

D) ability to pay

E) proportionality

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax that takes a higher percentage of income as income rises is called a(n)

A) proportional tax.

B) regressive tax.

C) progressive tax.

D) excise tax.

E) value-added tax.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the allocation of a nationʹs resources between additional public-sector spending versus additional private spending.John Kenneth Galbraith argued that

A) the value of the marginal dollar spent by government is less than the value of that dollar left in the hands of households or firms.

B) public sector spending is always subject to corruption and is therefore not as valuable as private spending.

C) the marginal utility of an additional dollarʹs worth of spending on public goods is higher than an additional dollarʹs worth of spending on private goods.

D) compared to public spending,private spending leads to more sustained long -run economic growth.

E) compared to private spending,public spending leads to more sustained long -run economic growth.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An income tax is progressive if,as income increases,

A) its average tax rate is increasing.

B) its marginal tax rate is falling.

C) its average tax rate is falling,but total taxes are increasing.

D) its average tax rate and marginal tax rate are constant while income is increasing.

E) its average tax rate is falling,but the marginal tax rate is increasing.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In Canada, the corporate income tax is integrated with the ________, so that ________ are not taxed twice on the firmʹs earnings.

A) sales tax; consumers

B) property tax; corporations

C) personal income tax; corporations

D) sales tax; shareholders

E) income tax; shareholders

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The important debate about the appropriate balance between the public and private sectors

A) has been solved in Canada.

B) is largely about the marginal benefits of public spending versus the marginal benefits of private spending,received for the last dollar spent.

C) was solved by John Kenneth Galbraith in his book The Affluent Society.

D) was solved by James Buchanan,a Nobel laureate .

E) should be decided by economists because they know the right balance.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The most important source of revenue for the Canadian federal government is ________ taxes; the most important source of revenue for Canadian municipal governments is ________ taxes.

A) income; excise

B) property; payroll

C) corporate; sales

D) sales; property

E) income; property

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table below shows 2015 federal income-tax rates in Canada.  TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 22%?

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $120 000,how much federal tax would be due from the earnings taxed at the rate of 22%?

A) $1629

B) $17 004

C) $9834

D) $26 400

E) $28 020

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table below shows 2015 federal income-tax rates in Canada.  TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $70 000,how much federal tax would be due?

TABLE 18-1

-Refer to Table 18-1.If an individual had a taxable income of $70 000,how much federal tax would be due?

A) $6004

B) $6406

C) $10 500

D) $12 271

E) $15 400

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose there is only one movie theatre in a town and the equilibrium price and quantity for movie admissions is $7 and 940 visits per week.Now suppose the government imposes a tax of $3 per movie admission,and the new equilibrium price and quantity are $8.75 and 750 visits per week.What is the direct burden of this tax?

A) $937.50

B) $1312.50

C) $1645

D) $2250

E) There is not enough information to know.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The various provincial sales taxes are mildly regressive because

A) richer households spend more in total and therefore pay more sales tax.

B) poorer households tend to spend a larger proportion of their incomes than richer households.

C) they are indirect taxes.

D) they are value added taxes.

E) richer households can avoid paying sales taxes while poorer households cannot.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In Canada,studentsʹ tuition fees for post -secondary education account for about

A) 12% of total costs.

B) 16% of total costs.

C) 24% of total costs.

D) 50% of total costs.

E) 54% of total costs.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

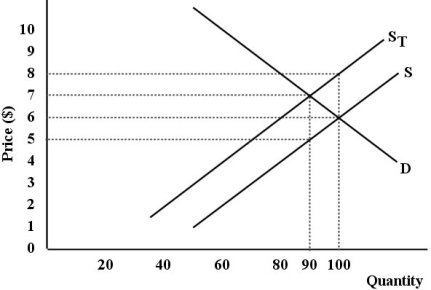

The diagram below shows supply and demand diagrams (S and D) for some product.The government then imposes an excise tax.The new supply curve is ST.

FIGURE 18-4

-Refer to Figure 18-4.What is the producersʹ net revenue after the imposition of the tax?

FIGURE 18-4

-Refer to Figure 18-4.What is the producersʹ net revenue after the imposition of the tax?

A) $450

B) $500

C) $540

D) $600

E) $630

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Employment Insurance (EI) system operates whereby

A) Canadians contribute during their working years and then receive payments when they are retired.

B) the federal government transfers funds to provincial governments.

C) any unemployed worker is paid while searching for employment.

D) the federal and provincial governments allow income-tax deductions for contributions made to special retirement funds.

E) eligible unemployed workers are paid while searching for new employment.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a firm buys $1000 worth of inputs from other firms,hires $1000 worth of labour services,and has sales revenue of $2500.The firmʹs resulting profit is $500.According to a value-added tax such as the GST,this firm would pay taxes on

A) $500.

B) $1000.

C) $1500.

D) $2500.

E) $4500.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a monopolist that is earning profits in the long run.If the government imposes a lump -sum tax on this monopolist (that is less than its profits) ,then

A) output would decrease and price to consumers would increase.

B) neither output nor price would change.

C) the output would remain the same while price increased.

D) the monopolist would cease production.

E) new firms would enter the industry.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 111

Related Exams