A) the smaller is the future value.

B) the higher is the interest rate.

C) the larger is the number of periods t.

D) the shorter is the time period t.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The key difference between bonds and stocks is that stocks' income streams are more predictable than those of bonds.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

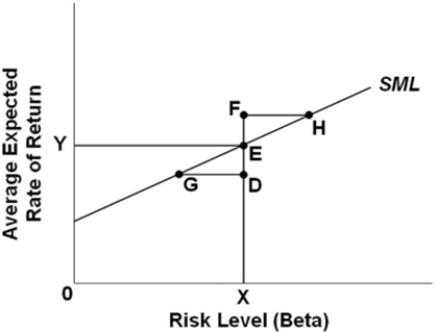

The Security Market line (SML) shows how the average expected rates of return on assets vary with

A) stock price.

B) dividend payment.

C) risk level.

D) time preference.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the present value of $5,000 to be received 10 years from now if the interest rate is 10 percent?

A) $1,927.72

B) $500

C) $4,545.45

D) $12,968.71

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the graph.Each labeled point represents a different asset.For which of these assets would we not expect arbitrage to change the average expected rate of return?

Refer to the graph.Each labeled point represents a different asset.For which of these assets would we not expect arbitrage to change the average expected rate of return?

A) E only

B) D, E, and F

C) E, G, and H

D) D, E, F, G, and H

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a popular type of investment?

A) dividends

B) portfolios

C) mutual funds

D) capital gains

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roger has the opportunity to invest $100,000 in two different assets. The investment in Asset #1 will have a present value of $120,000. The investment in Asset #2 is expected to have a future value of $140,000 in four years. If the market interest rate is 5 percent a year, which one would be the better investment?

A) Asset #2, because its future value is greater than the present value of Asset #1

B) Asset #1, because its present value is greater than the future value of Asset #2

C) Asset #2, because its present value is greater than the present value of Asset #1

D) Asset #1, because its present value is greater than the present value of Asset #2

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Susie has $500 invested in a financial asset earning an annually compounded interest rate of 8 percent.If Susie plans to cash in the asset when it is worth $700, about how long will she have to wait?

A) 4.4 years

B) 5 years

C) 6.1 years

D) 8 years

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The present value of a stream of lottery payments is less than the size of the stated jackpot.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank makes an auto loan for $10,000 at an annual rate of 6 percent.Assuming no repayment is made during the period, after two years the borrower will owe

A) $10,000.

B) $10,600.

C) $11,236.

D) $11,910.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An expansionary monetary policy will shift the Security Market Line down.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Riskier investments tend to sell for

A) lower prices, so they provide a higher expected rate of return to compensate for risk.

B) higher prices, so they provide a higher expected rate of return to compensate for risk.

C) higher prices; that is why they are considered to be riskier.

D) prices directly correlated with expected rates of return.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the financial crisis of 2007-2008, investors demanded much higher risk premiums in their investments.This caused the SML to

A) shift up.

B) shift down.

C) become steeper.

D) become flatter.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hermione is considering an investment that has a ¾ chance of paying a 10 percent rate of return and a ¼ chance of paying 2 percent.What is the average expected rate of return on the investment?

A) 2 percent.

B) 6 percent.

C) 8 percent.

D) 10 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bankruptcy of a firm means that it

A) earned less revenues than its total costs.

B) cannot meet its contractual obligations to its stockholders.

C) has a lot of debt owed to its bondholders.

D) is unable to make timely promised payments on its debt.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that two firms (Firm A and Firm B) are similar in all respects, but Firm A's stock has a higher rate of return than Firm B's stock.Arbitrage will occur as investors

A) sell Firm A's stock and buy Firm B's stock.

B) buy Firm A's stock and buy Firm B's stock also.

C) sell Firm A's stock and sell Firm B's stock also.

D) buy Firm A's stock and sell Firm B's stock.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Joseph is considering purchasing a condo. He has the option of buying one in Midtown with a present value of $150,000 or one in downtown with a future value of $200,000. If the current market interest rate is 5 percent and he wants to buy the home with the highest future value in 5 years, he should buy the condo in downtown.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a difference between stocks and bonds?

A) Bonds represent ownership; stocks represent debt.

B) Bonds make interest payments; stocks pay dividends.

C) Stock payouts are predictable; bond payouts are not.

D) All of these are differences between stocks and bonds.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Index funds

A) are passively managed.

B) are actively managed.

C) may be either passively or actively managed.

D) are neither passively nor actively managed.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alyssa is saving money for a vacation she wants to take five years from now.If the trip will cost $1,000 and she puts her money into a savings account paying 4 percent interest, compounded annually, how much would Alyssa need to deposit today to reach her goal without making further deposits?

A) $961.54

B) $923.75

C) $867.81

D) $821.93

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 323

Related Exams