Correct Answer

verified

Credit cards represent the ability to ge...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

Why do financial institutions keep reserves?

Correct Answer

verified

Reserves are required to satisfy deposit...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

Describe the basic features of a chartered bank's balance sheet.

Correct Answer

verified

The balance sheet of a chartered bank is...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

Suppose depositors at chartered banks transfer $10 billion from their savings deposits to their demand deposits.What impact does this have on M1, M2, and M2+?

Correct Answer

verified

Since M1 includes demand depos...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

What is the main method banks and other savings institutions use to make profits?

Correct Answer

verified

As private, profit-seeking bus...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

What is the difference between the M2 and M2+ definitions of the money supply?

Correct Answer

verified

M2 consists of everything in M1 (currenc...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

Describe the nature, causes, and effects of the U.S Mortgage Default Crisis.

Correct Answer

verified

In 2007, a wave of defaults on home mort...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

What are near monies?

Correct Answer

verified

Near monies are financial assets such as...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

What is the history behind the idea of a fractional reserve banking system?

Correct Answer

verified

Early traders used gold in making transa...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

What is meant by the overnight lending rate?

Correct Answer

verified

When financial institutions find themsel...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

What is a chartered bank (in Canada)?

Correct Answer

verified

A Canadian chartered bank is a...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

Suppose depositors at chartered banks transfer $10 billion from their savings deposits to their deposits in non-bank institutions.What impact does this have on M1, M2, and M2+?

Correct Answer

verified

Since M1 does not include either type of...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

Banks pursue two conflicting goals.Explain what they are and why the conflict.

Correct Answer

verified

The one goal is profit and the other goa...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

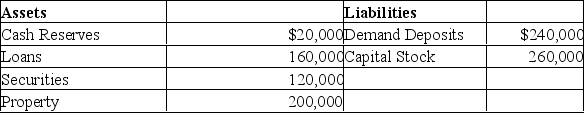

The following is the consolidated balance sheet for the chartered banking system.Assume the desired reserve ratio is 10%.Show the new consolidated balance sheet after maximum loan contraction has occurred.

Correct Answer

verified

The reserves are below desired levels by...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

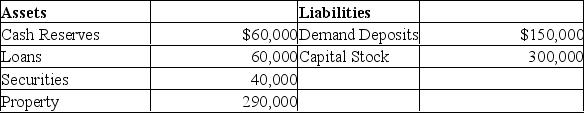

Arrange the following items in the form of a chartered bank's balance sheet, and explain how each might come into being.Capital stock, $300,000; Cash Reserves, $60,000; Property, $290,000; Demand deposits, $150,000; Securities, $40,000; Loans, $60,000

Correct Answer

verified

(a) Cash Reserves could come from deposi...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

Describe and explain what was done during the during the financial crisis of 2007-2008 in the United States (sometimes referred to as Extend and Pretend).

Correct Answer

verified

To prevent a total meltdown during the f...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

Money is what money does.Explain.

Correct Answer

verified

This refers to the idea that money (at l...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

What are Mortgage-Backed Securities and how are they created?

Correct Answer

verified

Mortgage-backed securities are bonds bac...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

The following is the consolidated balance sheet for the chartered banking system.Assume the desired reserve ratio is 33%.Show the new consolidated balance sheet after maximum loan expansion has occurred.

Correct Answer

verified

The excess reserves are $10,000 [60,000 ...View Answer

Show Answer

Correct Answer

verified

View Answer

Essay

Give an equation that shows the relationship between excess cash reserves, maximum demand-deposit expansion, and the monetary multiplier.

Correct Answer

verified

The maximum deposit expansion = excess c...View Answer

Show Answer

Correct Answer

verified

View Answer

Showing 21 - 40 of 56

Related Exams