A) government building a new road

B) Boeing Corporation building a new factory

C) a private citizen buying corporate stock

D) the Federal Reserve buying bonds from commercial banks

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

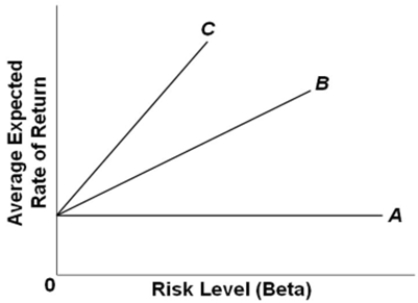

In the accompanying graph, bracket A represents the

In the accompanying graph, bracket A represents the

A) rate of return for an asset.

B) rate of return for the risk-free asset.

C) risk premium for an asset with a certain risk level.

D) compensation for time preference for an asset with a certain risk level.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alex wants to borrow $1,000 from Kara.If he repays the loan in one year, Kara will require him to pay 5 percent interest on the loan.If Alex wants to repay the loan over three years, but Kara strongly prefers present to future consumption, we would expect the interest rate on a three-year loan to be

A) lower than for a one-year loan.

B) greater than for a one-year loan.

C) the same as for a one-year loan.

D) higher if Kara expected there to be no inflation over the loan repayment period.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the difference between economic and financial investments?

A) Financial investments are sensitive to interest rates; economic investments are not.

B) Economic investments add to the capital stock of an economy; financial investments do not.

C) Economic investments are expressed in real (inflation-adjusted) terms; financial investments are expressed in nominal terms.

D) Financial investments include all purchases undertaken with the expectation of financial gain; economic investments include only purchases of new capital goods.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alyssa is saving money for a vacation she wants to take five years from now.If the trip will cost $1,000 and she puts her money into a savings account paying 4 percent interest, compounded annually, how much would Alyssa need to deposit today to reach her goal without making further deposits?

A) $961.54

B) $923.75

C) $867.81

D) $821.93

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An investment's rate of return is positively related to the price paid for it.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The two most important investor preferences are a desire for high rates of return and a dislike of inflation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk-free interest rate is determined primarily by the

A) largest commercial banks.

B) Internal Revenue Service.

C) U.S.Treasury.

D) Federal Reserve.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thea buys a house for $250,000, rents it for two years for $1,000 per month, and sells it at the end of those two years for $300,000.Thea's per-year rate of return is

A) 4.8 percent.

B) 14.8 percent.

C) 20 percent.

D) 29.6 percent.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be the best brief definition of present value?

A) assets minus liabilities incurred to acquire the assets

B) benefits of an investment minus its costs

C) the sum of all the past values of an asset

D) the current value of the expected future returns on an asset

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ownership of a single corporation is represented by what investment?

A) stock

B) bonds

C) mutual funds

D) commercial paper

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The risk premium is the rate that compensates for risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the graph.Which of the three Security Market Lines depicts the situation where investors most dislike risk?

Refer to the graph.Which of the three Security Market Lines depicts the situation where investors most dislike risk?

A) line A

B) line B

C) line C

D) It cannot be determined from the graph.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk premium of a financial asset is the

A) additional price that must be paid for riskier investments.

B) rate that compensates for risk.

C) rate that compensates for the risk of inflation.

D) same as the discount rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Advanced analysis) Alex wants to have $800 saved up at the end of 10 years.If he deposits $500 today, what annually compounded rate of interest would he have to earn to reach his goal?

A) 4.8 percent

B) 5.2 percent

C) 5.7 percent

D) 6.2 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that two firms (Firm A and Firm B) are similar in all respects, but Firm A's stock has a higher rate of return than Firm B's stock.Arbitrage will occur as investors

A) sell Firm A's stock and buy Firm B's stock.

B) buy Firm A's stock and buy Firm B's stock also.

C) sell Firm A's stock and sell Firm B's stock also.

D) buy Firm A's stock and sell Firm B's stock.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Mutual fund managers tend to focus on the long-term performance of the corporations in whose securities they are invested, rather than their short-term quarterly performance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Security Market Line (SML) is upward-sloping, indicating that the

A) beta of an investment increases as its risk level increases.

B) average expected return on investments decreases as their risk level decreases.

C) average expected return on the risk-free asset increases as its beta increases.

D) average expected return of the market portfolio increases as its beta increases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Shawna bought an antique table for $200 last year and is now selling it for $250.Her rate of return on the table is

A) 10 percent.

B) 20 percent.

C) 25 percent.

D) 30 percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank makes an auto loan for $10,000 at an annual rate of 6 percent.Assuming no repayment is made during the period, after two years the borrower will owe

A) $10,000.

B) $10,600.

C) $11,236.

D) $11,910.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 323

Related Exams