A) $225,000

B) $500,000

C) $525,000

D) $200,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Budgeting supports the planning process by encouraging all of the following activities except

A) requiring all organizational units to establish their goals for the upcoming period

B) increasing the motivation of managers and employees by providing agreed-upon expectations

C) directing and coordinating operations during the period

D) improving overall decision making by considering all viewpoints, options, and cost reduction possibilities

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If budgeted beginning inventory is $8,000, budgeted ending inventory is $9,400, and budgeted cost of goods sold is $10,260, budgeted production should be

A) $1,400

B) $9,600

C) $11,660

D) $11,550

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

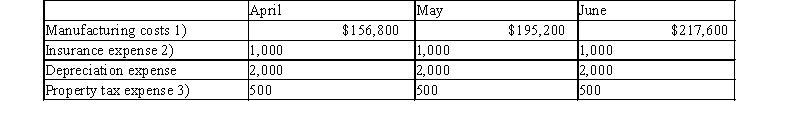

Finch Company began its operations on March 31 of the current year. Finch has the following projected costs:  1) Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month.

2) Insurance expense is $1,000 a month; however, the insurance is paid four times yearly in the first month of the quarter, i.e., January, April, July, and October) .

3) Property tax is paid once a year in November.

-The cash payments for Finch Company expected in the month of June are

1) Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month.

2) Insurance expense is $1,000 a month; however, the insurance is paid four times yearly in the first month of the quarter, i.e., January, April, July, and October) .

3) Property tax is paid once a year in November.

-The cash payments for Finch Company expected in the month of June are

A) $215,500

B) $188,800

C) $214,000

D) $212,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

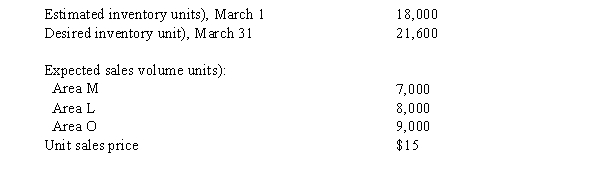

Production and sales estimates for March for the Robin Co. are as follows:  The number of units expected to be manufactured in March is

The number of units expected to be manufactured in March is

A) 24,000

B) 27,000

C) 27,600

D) 21,600

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The budget procedure that requires all levels of management to start from zero in estimating sales, production, and other operating data is called zero-based budgeting.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The first budget to be prepared is usually the production budget.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Flexible budgeting builds the effect of changes in level of activity into the budget system.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The Tough Jeans Company produces two different styles of jeans, Working Life and Social Life. The company sales budget estimates that 400,000 of the Working Life jeans and 250,000 of the Social Life jeans will be sold during the year. The company begins with 9,000 pairs of Working Life and 18,000 pairs of Social Life. The company desires ending inventory of 7,500 of Working Life and 10,000 Social Life. Prepare a production budget for the year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

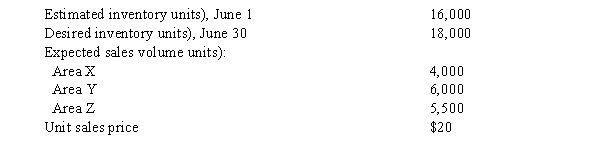

Production and sales estimates for June are as follows:  The number of units expected to be manufactured in June is

The number of units expected to be manufactured in June is

A) 15,500

B) 17,500

C) 16,500

D) 13,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the expected sales volume for the current period is 9,000 units, the desired ending inventory is 200 units, and the beginning inventory is 300 units, the number of units set forth in the production budget, representing total production for the current period, is

A) 9,000

B) 8,900

C) 8,700

D) 9,100

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary difference between a static budget and a flexible budget is that a static budget

A) is suitable in volatile demand situation while flexible budget is suitable in a stable demand situation

B) is concerned only with future acquisitions of fixed assets, whereas a flexible budget is concerned with expenses that vary with sales

C) includes only fixed costs, whereas a flexible budget includes only variable costs

D) is a plan for a single level of production, whereas a flexible budget can be converted to any level of production

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

Prepare a monthly flexible selling expense budget for Cottonwood Company for sales volumes of $300,000, $350,000, and $400,000, based on the following data Sales commissions Sales manager's salary Advertising expense Shipping expense Miscellaneous selling expense 6% of sales $120,000 per month $90,000 per month 1% of sales $6,000 per month plus 1.5% of sales

Correct Answer

verified

Correct Answer

verified

Essay

Big Wheel, Inc. collects 25% of its sales on account in the month of the sale and 75% in the month following the sale. Sales on account are budgeted to be $150,000 for March and receipts from sales on account total $162,500 in April. What are budgeted sales on account for April?

Correct Answer

verified

Correct Answer

verified

True/False

The capital expenditures budget details future plans for acquisition of fixed assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each phrase that follows with the term a-e) it describes. -occurs when budgets are too loose

A) planning

B) directing

C) controlling

D) budget slack

E) goal conflict

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash collections expected in October from accounts receivable are estimated to be

A) $246,400

B) $262,500

C) $210,000

D) $294,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The production budget is the starting point for preparation of the direct labor cost budget.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The dollar amount of Material B used in production during the year is

A) $1,057,400

B) $1,193,400

C) $1,026,800

D) $1,224,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The capital expenditures budget is part of the planned investing activities of a company.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 197

Related Exams