A) It helps firms to more easily adjust real wages

B) It allows a margin of error for those deciding on the money supply

C) It allows the Fed to more easily engage in expansionary monetary policy

D) It increases the real wage of workers

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tax distortions happen because tax laws only take _______ into consideration.

A) nominal income

B) real income

C) nominal output

D) real output

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

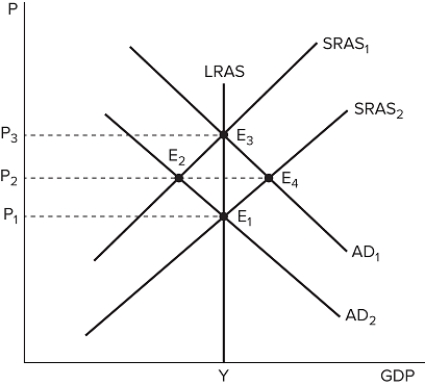

The graph shown displays various price and output levels in an economy.  What does the "Y" on the x-axis stand for?

What does the "Y" on the x-axis stand for?

A) Full employment level of output

B) Current level of GDP

C) Observed level of output

D) Future target goal for output

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not associated with predictable inflation?

A) Menu costs

B) Shoe-leather costs

C) Tax distortions

D) Labor costs

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Applying contractionary monetary policy when the inflation rate is near zero could cause:

A) inflation.

B) stagflation.

C) deflation.

D) Monetary policy does not affect prices when the inflation rate is near zero.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an economy produces 1,000 units of output when the price level is $1 and the money supply is $500, what is the velocity of money?

A) 2

B) 500

C) 50

D) 5

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the annual nominal interest rate is 7 percent and the inflation rate is 7 percent. If you deposit $1,000, at the end of the year:

A) your purchasing power will have increased.

B) your purchasing power will have stayed the same.

C) your savings will have a nominal decrease.

D) your purchasing power will have decreased.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The graph shown displays various price and output levels in an economy.  Which point on the graph would represent a recession?

Which point on the graph would represent a recession?

A) E 1

B) E 2

C) E 3

D) E 4

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity theory of money relies on which variable to remain constant?

A) The velocity of money

B) The money supply

C) The price level

D) Unemployment

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tax distortion refers to the cost of inflation that comes from:

A) the money, time, and opportunity used to change prices to keep pace with inflation.

B) the time, money, and effort one has to spend managing cash in the face of inflation.

C) the higher taxes one must pay when earning a greater dollar amount, even though real purchasing power hasn't changed.

D) the labor costs associated with inflation.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the quantity theory of money, an increase in the money supply leads to a(n) _______ in prices, as _______ dollar bills are spent on _______ goods and services.

A) increase; more; the same number of

B) increase; the same number of; more

C) decrease; more; the same number of

D) decrease; the same number of; more

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The classical theory of inflation illustrates the relationship between which elements? I. The money supply II) Spending III) Savings IV) Output V, Investment VI) The overall price level

A) I, IV, and VI

B) II, III, and VI

C) I, IV, and V

D) II, III, and V

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an economy produces 2,500 units of output when the money supply is $500 and the velocity of money is 10, what is the price level?

A) $1

B) $5

C) $2

D) $10

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During a bout of hyperinflation, suppose the country of Weimar announces it will be rolling out a new currency, the Weimar Mark, which is worth 1 million Marks. Neutrality of money suggests this change will:

A) not influence prices in the overall economy.

B) dramatically decrease real wealth.

C) only change core inflation.

D) None of these are true.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Deflation is a problem because it:

A) increases the value of debt, making it harder to pay it back.

B) increases the time it takes for monetary policy to be effective.

C) increases shoe-leather costs.

D) reduces the effectiveness of fiscal policy in stimulating the economy.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an economy produces 3,000 units of output when the price level is $2 and the velocity of money is 12, what is the money supply?

A) $1,000

B) $500

C) $2,000

D) $4,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the nominal interest rate is higher than the real interest rate, then inflation must be:

A) zero.

B) higher than the nominal rate of interest.

C) positive.

D) negative.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the nominal interest rate is higher than the inflation rate, the value of your savings:

A) will increase.

B) will decrease.

C) should remain about the same.

D) cannot be determined without knowing its starting balance.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the quantity theory of money, the Fed could combat inflation by:

A) decreasing the supply of money.

B) increasing the supply of money.

C) reducing taxes.

D) increasing taxes.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity theory of money explicitly states that:

A) the value of money is determined by the overall quantity of money in existence.

B) real GDP is determined by the money supply.

C) the money supply is determined by the price level.

D) there is no relationship between the value of money and the quantity of money in existence.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 151

Related Exams