A) 24.0%

B) 31.62%

C) 3.0%

D) 9.3%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

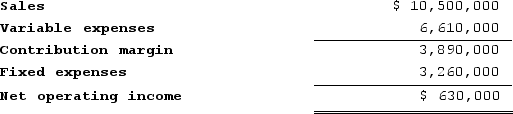

Youns Incorporated reported the following results from last year's operations:  The company's average operating assets were $5,000,000.At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

The company's average operating assets were $5,000,000.At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales. If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

A) 9.50

B) 1.64

C) 2.66

D) 2.08

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

For performance evaluation purposes, any variance over budgeted fixed costs in a service department should be the responsibility of the service department and should not be charged to the departments that use the service.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

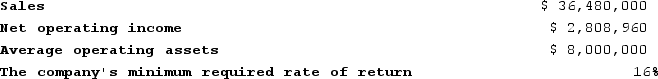

Dacker Products is a division of a major corporation. The following data are for the most recent year of operations:  The division's return on investment (ROI) is closest to:

The division's return on investment (ROI) is closest to:

A) 6.3%

B) 2.7%

C) 35.1%

D) 160.1%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Division R of Harris Corporation has the capacity for making 40,000 wheel sets per year and regularly sells 36,000 each year on the outside market. The regular selling price on the outside market is $89 per wheel set, and the variable production cost per unit is $56. Division S of Harris Corporation currently buys 6,000 wheel sets (of the kind made by Division R) yearly from an outside supplier at a price of $85 per wheel set. If Division S were to buy the 6,000 wheel sets it needs annually from Division R at $83 per wheel set, the change in annual net operating income for the company as a whole, compared to what it is currently, would be:

A) $108,000

B) $174,000

C) $162,000

D) $96,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

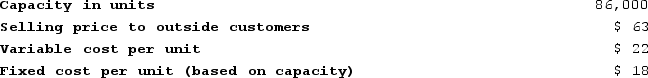

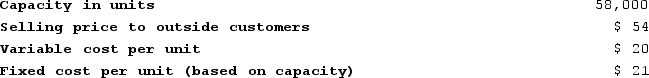

Stokan Products, Incorporated, has a Antennae Division that manufactures and sells a number of products, including a standard antennae that could be used by another division in the company, the Aircraft Products Division, in one of its products. Data concerning that antennae appear below:  The Aircraft Products Division is currently purchasing 5,000 of these antennaes per year from an overseas supplier at a cost of $57 per antennae.What is the maximum price that the Aircraft Products Division should be willing to pay for antennaes transferred from the Antennae Division?

The Aircraft Products Division is currently purchasing 5,000 of these antennaes per year from an overseas supplier at a cost of $57 per antennae.What is the maximum price that the Aircraft Products Division should be willing to pay for antennaes transferred from the Antennae Division?

A) $22 per unit

B) $57 per unit

C) $18 per unit

D) $40 per unit

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

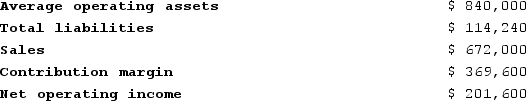

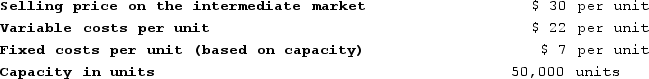

Given the following data:  Return on investment (ROI) is:

Return on investment (ROI) is:

A) 30.0%

B) 24.0%

C) 55.0%

D) 44.0%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

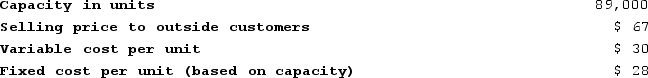

Wigelsworth Products, Incorporated, has a Sensor Division that manufactures and sells a number of products, including a standard sensor. Data concerning that sensor appear below:  The Safety Products Division of Wigelsworth Products, Incorporated needs 6,000 special heavy-duty sensors per year. The Sensor Division's variable cost to manufacture and ship this special sensor would be $32 per unit. Because these special sensors require more manufacturing resources than the standard sensor, the Sensor Division would have to reduce its production and sales of standard sensors to outside customers from 89,000 units per year to 79,400 units per year. From the standpoint of the Sensor Division, what is the minimal acceptable transfer price for the special sensors for the Safety Products Division?

The Safety Products Division of Wigelsworth Products, Incorporated needs 6,000 special heavy-duty sensors per year. The Sensor Division's variable cost to manufacture and ship this special sensor would be $32 per unit. Because these special sensors require more manufacturing resources than the standard sensor, the Sensor Division would have to reduce its production and sales of standard sensors to outside customers from 89,000 units per year to 79,400 units per year. From the standpoint of the Sensor Division, what is the minimal acceptable transfer price for the special sensors for the Safety Products Division?

A) $60.00 per unit

B) $67.00 per unit

C) $69.00 per unit

D) $91.20 per unit

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following will not result in an increase in return on investment (ROI) , assuming other factors remain the same?

A) A reduction in expenses.

B) An increase in net operating income.

C) An increase in operating assets.

D) An increase in sales.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

All charges for services computed using budgeted rather than actual rates should be removed from an operating department's performance report.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Division C makes a part that it sells to customers outside of the company. Data concerning this part appear below:  Division D of the same company would like to use the part manufactured by Division C in one of its products. Division D currently purchases a similar part made by an outside company for $39 per unit and would substitute the part made by Division C. Division D requires 5,810 units of the part each period. Division C has ample excess capacity to handle all of Division D's needs without any increase in fixed costs and without cutting into outside sales. What is the lowest acceptable transfer price from the standpoint of the selling division?

Division D of the same company would like to use the part manufactured by Division C in one of its products. Division D currently purchases a similar part made by an outside company for $39 per unit and would substitute the part made by Division C. Division D requires 5,810 units of the part each period. Division C has ample excess capacity to handle all of Division D's needs without any increase in fixed costs and without cutting into outside sales. What is the lowest acceptable transfer price from the standpoint of the selling division?

A) $40

B) $39

C) $36

D) $37

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

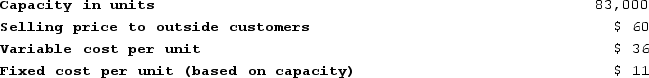

Siegrist Products, Incorporated has a Pump Division that manufactures and sells a number of products, including a standard pump that could be used by another division in the company, the Pool Products Division, in one of its products. Data concerning that pump appear below:  The Pool Products Division is currently purchasing 12,000 of these pumps per year from an overseas supplier at a cost of $54 per pump. Assume that the Pump Division has enough idle capacity to handle all of the Pool Products Division's needs. What should be the minimum acceptable transfer price for the pumps from the standpoint of the Pump Division?

The Pool Products Division is currently purchasing 12,000 of these pumps per year from an overseas supplier at a cost of $54 per pump. Assume that the Pump Division has enough idle capacity to handle all of the Pool Products Division's needs. What should be the minimum acceptable transfer price for the pumps from the standpoint of the Pump Division?

A) $47 per unit

B) $60 per unit

C) $36 per unit

D) $54 per unit

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dacker Products is a division of a major corporation. The following data are for the most recent year of operations:  The division's margin used to compute return on investment is closest to:

The division's margin used to compute return on investment is closest to:

A) 30.3%

B) 35.5%

C) 22.4%

D) 7.9%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

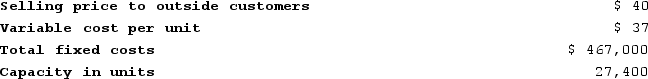

Fregozo Products, Incorporated, has a Connector Division that manufactures and sells a number of products, including a standard connector that could be used by another division in the company, the Transmission Division, in one of its products. Data concerning that connector appear below:  The Transmission Division is currently purchasing 8,000 of these connectors per year from an overseas supplier at a cost of $45 per connector.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $10 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What should be the minimum acceptable transfer price for the valves from the standpoint of the Valve Division?

The Transmission Division is currently purchasing 8,000 of these connectors per year from an overseas supplier at a cost of $45 per connector.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $10 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. What should be the minimum acceptable transfer price for the valves from the standpoint of the Valve Division?

A) $31 per unit

B) $54 per unit

C) $44 per unit

D) $45 per unit

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Consumer Products Division of Goich Corporation had average operating assets of $800,000 and net operating income of $81,300 in May. The minimum required rate of return for performance evaluation purposes is 10%.What was the Consumer Products Division's residual income in May?

A) $(1,300)

B) $8,130

C) $1,300

D) $(8,130)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

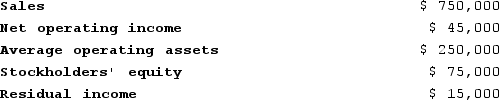

The following data are for the Akron Division of Consolidated Rubber, Incorporated:  For the past year, the margin used in return on investment calculations was:

For the past year, the margin used in return on investment calculations was:

A) 6.00%

B) 8.67%

C) 10.00%

D) 8.00%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

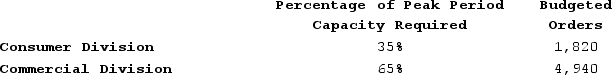

Levar Corporation has two operating divisions-a Consumer Division and a Commercial Division. The company's Order Fulfillment Department provides services to both divisions. The variable costs of the Order Fulfillment Department are budgeted at $31 per order. The Order Fulfillment Department's fixed costs are budgeted at $288,000 for the year. The fixed costs of the Order Fulfillment Department are determined based on the peak period orders.  At the end of the year, actual Order Fulfillment Department variable costs totaled $216,867 and fixed costs totaled $282,600. The Consumer Division had a total of 1,840 orders and the Commercial Division had a total of 4,895 orders for the year. For purposes of evaluation performance, how much Order Fulfillment Department cost should be charged to the Commercial Division at the end of the year?

At the end of the year, actual Order Fulfillment Department variable costs totaled $216,867 and fixed costs totaled $282,600. The Consumer Division had a total of 1,840 orders and the Commercial Division had a total of 4,895 orders for the year. For purposes of evaluation performance, how much Order Fulfillment Department cost should be charged to the Commercial Division at the end of the year?

A) $358,026

B) $347,603

C) $367,077

D) $338,945

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

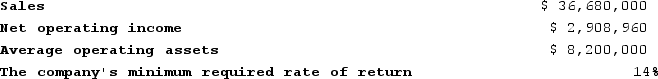

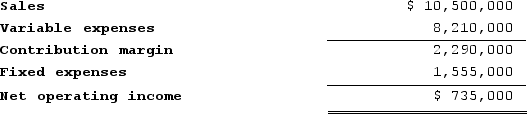

Anguiano Incorporated reported the following results from last year's operations:  The company's average operating assets were $5,000,000. Last year's return on investment (ROI) was closest to:

The company's average operating assets were $5,000,000. Last year's return on investment (ROI) was closest to:

A) 7.0%

B) 14.7%

C) 45.8%

D) 47.6%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

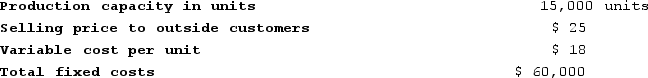

Division S of Kracker Company makes a part that it sells to other companies. Data on that part appear below:  Division B, another division of Kracker Company, presently is purchasing 10,000 units of a similar product each period from an outside supplier for $28 per unit, but would like to begin purchasing from Division S.Suppose that Division S has ample idle capacity to handle all of Division B's needs without any increase in fixed costs or cutting into sales to outside customers. If Division S refuses to accept a transfer price of $28 or less and Division B continues to buy from the outside supplier, the company as a whole will:

Division B, another division of Kracker Company, presently is purchasing 10,000 units of a similar product each period from an outside supplier for $28 per unit, but would like to begin purchasing from Division S.Suppose that Division S has ample idle capacity to handle all of Division B's needs without any increase in fixed costs or cutting into sales to outside customers. If Division S refuses to accept a transfer price of $28 or less and Division B continues to buy from the outside supplier, the company as a whole will:

A) gain $20,000 in potential profit.

B) lose $60,000 in potential profit.

C) lose $70,000 in potential profit.

D) lose $20,000 in potential profit.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Division A makes a part with the following characteristics:  Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division B is now purchasing these parts from an outside supplier at a price of $24 each.Suppose that Division A has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into sales to outside customers. If Division A refuses to accept the $24 price internally and Division B continues to buy from the outside supplier, the company as a whole will be:

Division B, another division of the same company, would like to purchase 5,000 units of the part each period from Division A. Division B is now purchasing these parts from an outside supplier at a price of $24 each.Suppose that Division A has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without cutting into sales to outside customers. If Division A refuses to accept the $24 price internally and Division B continues to buy from the outside supplier, the company as a whole will be:

A) worse off by $30,000 each period.

B) worse off by $10,000 each period.

C) better off by $15,000 each period.

D) worse off by $35,000 each period.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 335

Related Exams