A) Positive

B) Negative

C) Zero

D) All of these are equally likely.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount that a firm receives from the sale of goods and services is called:

A) total cost.

B) total revenue.

C) profit.

D) maximum profit.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marginal cost is:

A) the additional output a firm will get by employing one additional unit of input.

B) the additional cost a firm will incur by producing one additional unit of output.

C) the total cost a firm will incur by producing a given level of output.

D) the costs that sit on the margin, that do not change regardless of the level of output.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Davy's Doggie Daycare rents a warehouse and field for $2,000 a month to house its boarded pooches. Farmer Fred owns the property; he used to use it for farming and made $3,000 a month, but has since retired. What is the cost of the warehouse and field to Davy?

A) It is an explicit cost of $2,000.

B) It is an implicit cost of $3,000.

C) It is an implicit cost of $0.

D) There is both an explicit and implicit cost totalling $5,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Explicit costs are costs that:

A) require a firm to spend money.

B) are zero when no output is produced.

C) do not depend on the quantity of output produced.

D) depend on the quantity of output produced.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

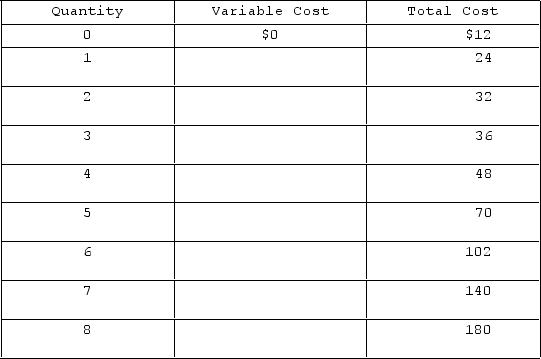

The table shows costs for an individual firm. What is the marginal cost of the third unit produced?

The table shows costs for an individual firm. What is the marginal cost of the third unit produced?

A) 12

B) 14

C) 36

D) 48

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A soft drink factory employs seven workers and produces 500 bottles of soda a day. When the company reduces the workforce to six workers output decreases to 450 bottles a day. The seventh worker:

A) had a marginal product of 50 bottles of soda.

B) caused average product to fall.

C) had a lower marginal product than the sixth worker.

D) All of these are correct.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Imagine Tom's annual salary as an assistant store manager is $30,000. He also owns a building that he rents out, earning $10,000 annually, and he has financial assets that generate $1,000 per year in interest. One day, after deciding to be his own boss, he quits his job, evicts his tenants, and uses his financial assets to establish a bicycle repair shop in the building he owns. To run the business, he outlays $15,000 in cash to cover all the costs involved with running the business, and earns revenues of $50,000. What is Tom's accounting profit?

A) $50,000

B) $24,000

C) $35,000

D) −$6,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A college student is thinking about running an ice cream truck over the summer. Which of the following would likely be a one-time expense of the business?

A) The cost of ice cream cones

B) The cost of the truck

C) The cost of the gasoline

D) All of these are one-time expenses.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Average product measures:

A) the quantity of output produced per unit of input.

B) the additional output created from an additional unit of input.

C) marginal product averaged across all inputs.

D) All of these are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is total revenue calculated?

A) Cost multiplied by the quantity of each item produced

B) Price multiplied by the quantity of each item sold, subtracted from total cost

C) Price multiplied by the quantity of each item sold

D) None of these calculations are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marginal cost:

A) is calculated as the change in total cost divided by the change in total output.

B) is calculated as the change in total output divided by the change in total cost.

C) increases then decreases, as output increases, to reflect marginal product.

D) All of these are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Diminishing marginal product:

A) causes the variable cost curve to become flatter.

B) causes the variable cost curve to become steeper.

C) has no relation to the variable cost curve.

D) causes the fixed cost curve to become flatter.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total revenue is:

A) the amount that a firm spends on all inputs that go into producing a good or service.

B) the quantity sold multiplied by the price paid for each unit.

C) the quantity produced multiplied by the cost of producing each unit.

D) the amount that an individual gets paid over a specified period of time, typically annually.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In general, the cost of an input _____ when a firm has reached the point of diminishing marginal product.

A) decreases

B) stays the same

C) increases

D) is minimized

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Constant returns to scale occur when:

A) an increase in the quantity of output decreases average total cost in the long run.

B) an increase in the quantity of output increases average total cost in the long run.

C) average total cost does not depend on the quantity of output in the long run.

D) None of these are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company's accounting profit is negative, what will the economic profit be?

A) Positive

B) Negative

C) Zero

D) It could be positive, negative, or zero.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Larry's Lariats produces lassos in a factory, using nine feet of rope to make each lasso. The rope is put into a machine that automatically cuts it to the right length and seals the ends to prevent fraying. The rope is then hand tied, dipped, and wound before being placed in a packaging machine to prepare it for retail sale. Which of the following expenses would be considered a fixed cost for this company?

A) Employee wages

B) The cost of rope

C) The packaging material

D) None of these expenses are fixed costs.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How long is the short run?

A) It is typically defined by the process cycle of the particular firm.

B) It is defined by the presence of a fixed cost for a firm.

C) It is generally less than a year.

D) All of these are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marginal cost curve:

A) is U-shaped.

B) rises when marginal product falls, and falls when marginal product rises.

C) intersects the average total cost curve at its minimum.

D) All of these are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 152

Related Exams