Correct Answer

verified

Correct Answer

verified

Multiple Choice

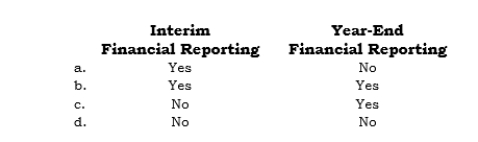

_____ Cableco estimated its annual effective income tax rate to be 40% at the end of its first quarterly interim period for 2006. At the end of the third quarter for 2006, Cableco revised its estimated annual effective income tax rate to be 36%. Cableco had pretax income of $1,000,000 for each of the first three quarters and expects earnings for the fourth quarter to be $2,000,000. What amount should be reported for income tax expense in the third quarter interim report for the year-to-date (nine month) results?

A) $1,080,000

B) $1,120,000

C) $1,160,000

D) $1,200,000

E) None of the above.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

______ Cableco estimated its annual effective income tax rate to be 40% at the end of its first quarterly interim period for 2006. At the end of the third quarter for 2006, Cableco revised its estimated annual effective income tax rate to be 36%. Cableco had pretax income of $1,000,000 for each of the first three quarters and expects earnings for the fourth quarter to be $2,000,000. What amount should be reported for income tax expense for the third quarter in the third quarter interim report?

A) $280,000

B) $320,000

C) $360,000

D) $400,000

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

In interim reporting, an interim period is considered a part of an annual period under the ___________________________view.

Correct Answer

verified

Correct Answer

verified

Short Answer

_____ Property taxes may be accrued or deferred to provide an appropriate cost in each period for

Correct Answer

verified

Correct Answer

verified

True/False

Quarterly financial reporting is a requirement under GAAP as promulgated by the FASB and its predecessor organizations.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

_____ For interim financial reporting, which of the following items may be prorated over each of the quarters instead of being expensed in the quarter in which incurred or paid?

Correct Answer

verified

Correct Answer

verified

True/False

Certified public accountants of publicly owned companies are required to review interim financial reports prior to their release.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under APB Opinion No. 28, either a condensed or a complete income statement is to be included in interim financial reports.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

_____ Under APB Opinion No. 28, interim financial reports are to include, as a minimum,

A) A condensed income statement.

B) A complete income statement.

C) Comparative income statements.

D) Specified income statement items.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Under APB Opinion No. 28, changes in accounting estimates are required to be accounted for in the first interim reporting period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The inclusion of quarterly financial data in the annual report to stockholders is voluntary for publicly owned companies.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the discrete view, the period of time for which results of operations are being determined should not influence how such transactions and events should be reported.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The objective of interim reporting is to use the same accounting principles and practices used in preparing annual financial statements.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under APB Opinion No. 28, extraordinary items must be reported in the interim period in which they occur.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

_____ Interim financial reports issued by publicly owned companies

A) Are required to be audited before they are released.

B) Are required to be reviewed by auditors before their release.

C) Do not have to be reviewed or audited by auditors prior to their release.

D) Are required to be reviewed by auditors if they are 10-Q quarterly reports being filed with the SEC.

E) None of the above.

G) B) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

_____ In January 2006, Nollex paid property taxes of $20,000 covering the calendar year 2006. Also in January 2006, Nollex estimated tht its year-end bonuses to factory workers would be $80,000 for 2006. In Nollex's quarterly income statement for the three months ended 3/31/06, what is the total amount of expense relating to these two items that should be reported?

A) $25,000

B) $20,000

C) $5,000

D) $ -0-

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Under APB Opinion No. 28, certain costs and expenses (other than product costs) that clearly benefit more than one interim period ______________________________ be allocated among interim periods benefited.

Correct Answer

verified

Correct Answer

verified

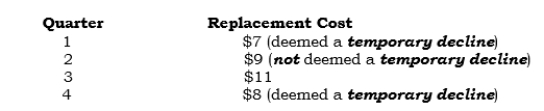

Essay

Temporex had 1,000 units of an item on hand at the beginning of 2006, which were valued at their acquisition cost of $10 per unit. No additional purchases of this item occurred during 2006. For simplicity, assume that no sales of this item were made in 2006. The replacement cost (assumed to be market) at the end of each quarter follows:

Required:

Determine the charge or credit, if any, to be made to earnings for each quarter of 2006.

Required:

Determine the charge or credit, if any, to be made to earnings for each quarter of 2006.

Correct Answer

verified

Correct Answer

verified

Short Answer

_____ For interim financial reporting, which of the following may be accrued or deferred to provide an appropriate cost in each period?

Correct Answer

verified

C

Correct Answer

verified

Showing 1 - 20 of 49

Related Exams