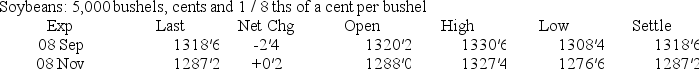

A) $160.30

B) $1,912.00

C) $8,040.00

D) $16,030.00

E) $19,120.00

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

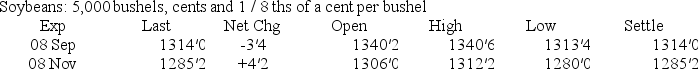

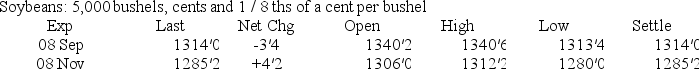

Use the following soybean futures quotes to answer this question.

-Last week,you purchased four November 08 soybean futures contracts when the price quote was 1300΄6.What is your current profit or loss on this investment?

-Last week,you purchased four November 08 soybean futures contracts when the price quote was 1300΄6.What is your current profit or loss on this investment?

A) -$3,100.00

B) -$2,625.00

C) -$31.00

D) $987.50

E) $3,350.00

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

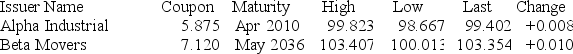

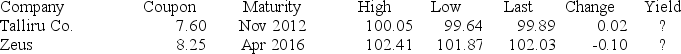

Use the following bond quotes to answer this question:

-What is the current price of a $1,000 face value Alpha Industrial bond?

-What is the current price of a $1,000 face value Alpha Industrial bond?

A) $986.67

B) $991.04

C) $994.02

D) $998.23

E) $1,000.00

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You will earn a profit as the owner of a call option if the price of the underlying asset:

A) decreases.

B) remains constant or decreases.

C) remains constant.

D) remains constant or increases.

E) increases.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchased four put option contracts with a strike price of $35 and a premium of $0.80.What is the total net amount you will receive for your shares if you exercise this contract when the underlying stock is selling for $31.50 a share?

A) $13,680

B) $14,700

C) $15,740

D) $16,340

E) $16,400

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investing in a futures contract:

A) guarantees a sale but not a sale price.

B) can be profitable for both the buyer and the seller simultaneously.

C) guarantees the buyer a profit on the contract.

D) creates a gain for one party without causing a loss for the other party.

E) can be offset by taking an opposing position.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A contract that grants its buyer the right,but not the obligation,to sell an asset at a specified price is called a:

A) futures contract.

B) call option.

C) preset contract.

D) put option.

E) primary contract.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An agreement that grants the owner the right,but not the obligation,to buy or sell a specific asset at a specified price during a specified time period is called a(n) ________ contract.

A) futures

B) obligatory

C) quoted

D) fixed

E) option

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preferred stock:

A) represents the residual ownership of a corporation.

B) is generally issued only by new firms that are small in size.

C) has a fixed maturity date similar to a bond.

D) dividends can be skipped at the discretion of the company president.

E) may or may not be cumulative.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 3.5 percent coupon bond is currently quoted at 91.3 and has a face value of $1,000.What is the amount of each semi-annual coupon payment if you own three (3) of these bonds?

A) $52.50

B) $75.00

C) $100.46

D) $110.00

E) $200.93

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harvest Fields sold ten September futures contracts on oats.Harvest Fields will:

A) pay for the oats in September.

B) take delivery of the oats in September.

C) pay for the oats now and take delivery in September.

D) receive payment now and deliver in September.

E) both receive payment and deliver in September.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

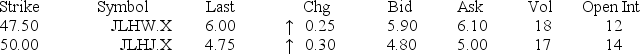

Use these option quotes to answer this question:

-The price you will pay (per underlying share) to buy the 50 call option on JL stock is:

-The price you will pay (per underlying share) to buy the 50 call option on JL stock is:

A) $4.75.

B) $4.80.

C) $5.00.

D) $5.90.

E) $6.00.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

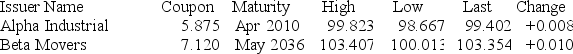

Use the following bond quotes to answer this question:

-The Alpha Industrial bonds pay an annual interest payment equal to 5.875 percent of:

-The Alpha Industrial bonds pay an annual interest payment equal to 5.875 percent of:

A) $999.90.

B) $1,000.00.

C) $1,000.13.

D) $1,033.54.

E) $1,034.07.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following bond quotes to answer this question:

-If you purchase five Zeus bonds,the cost will be ________ and the annual interest income will be ________.

-If you purchase five Zeus bonds,the cost will be ________ and the annual interest income will be ________.

A) $5,000.00; $388.75

B) $5,000.00; $412.50

C) $5,000.00; $460.00

D) $5,101.50; $412.50

E) $5,101.50; $460.00

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preferred stock:

A) is a type of corporate debt.

B) is treated like debt for tax purposes.

C) is listed in the liabilities section of a balance sheet.

D) has a stated dividend but no stated liquidation value.

E) is treated like equity for both tax and accounting purposes.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $1,000 face value bond has a 6.85 percent semi-annual coupon and sells for $980.00.What is the current yield?

A) 6.75 percent

B) 6.82 percent

C) 6.89 percent

D) 6.99 percent

E) 6.61 percent

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following soybean futures quotes to answer this question:

-What was the total price fluctuation on one September 08 soybeans contract today?

-What was the total price fluctuation on one September 08 soybeans contract today?

A) $1,337.50

B) $1,362.50

C) $1,412.50

D) $1,460.00

E) $1,482.50

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own 300 shares of stock which you would like to have the right to sell at $40 a share.The 40 call option is quoted at $0.35 bid,$0.40 ask.The 40 put is quoted at $0.45 bid,$0.50 ask.How much will it cost you to obtain the right to sell all of your shares at $40 a share?

A) $135

B) $50

C) $150

D) $105

E) $75

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

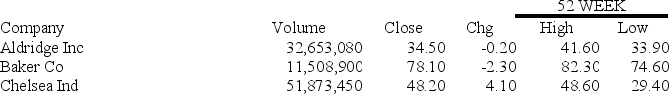

Use the following stock quotes to answer this question:

-What was the previous day's closing price for Baker Co.stock?

-What was the previous day's closing price for Baker Co.stock?

A) $44.70

B) $54.10

C) $68.20

D) $78.10

E) $80.40

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following soybean futures quotes:

-You purchased four November 08 futures contracts on soybeans when they first became available this morning.Your investment has been worth as little as ________ and as much as ________.

-You purchased four November 08 futures contracts on soybeans when they first became available this morning.Your investment has been worth as little as ________ and as much as ________.

A) $255,350; $265,500

B) $255,350; $265,020

C) $257,440; $265,500

D) $257,440; $265,020

E) $257,440; $265,520

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 94

Related Exams