A) seller of the option receives the strike price.

B) seller of the option receives the option premium.

C) buyer of the option sells the underlying asset and receives the option premium.

D) buyer of the option pays the option premium and receives the underlying asset.

E) seller of the option must buy the underlying asset and pay the strike price.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

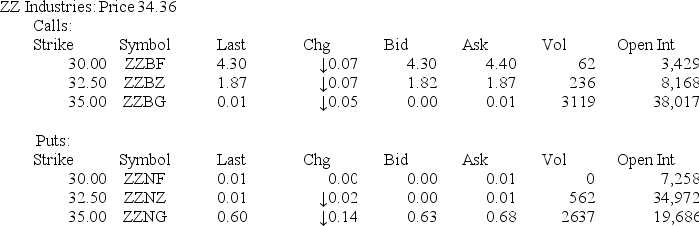

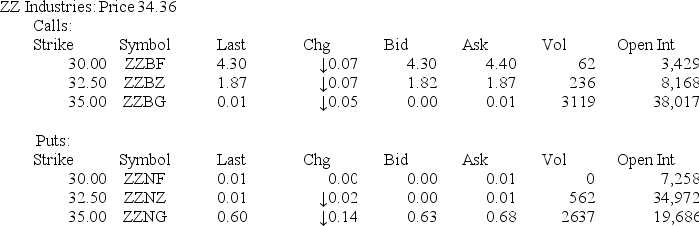

Use these option quotes to answer this question:

-You purchased four call option contracts with a strike price of $40 and an option premium of $1.25.You closed your contract on the expiration date when the stock was selling for $42.50 a share.What is your total profit or loss on your option position?

-You purchased four call option contracts with a strike price of $40 and an option premium of $1.25.You closed your contract on the expiration date when the stock was selling for $42.50 a share.What is your total profit or loss on your option position?

A) -$50

B) -$10

C) $135

D) $385

E) $500

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is classified as a fixed-income security?

A) U.S. Treasury bill

B) 6-month municipal bond

C) common stock that pays regular quarterly dividends

D) 2-year U.S. Treasury security

E) 9-month bank certificate of deposit

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are generally included in a standardized futures contract? I.delivery date II.quantity to be delivered III.specific item to be delivered IV.delivery location

A) I and II only

B) I, II, and III only

C) II, III, and IV only

D) I, III, and IV only

E) I, II, III, and IV

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

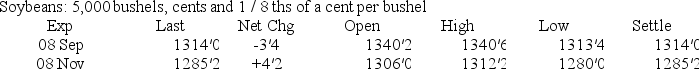

Use the following soybean futures quotes to answer this question:

-Julie was lucky enough to purchase two September 08 futures contracts on soybeans when the contracts were at the lowest price of the day.What is Julie's total profit or loss as of the end of the day?

-Julie was lucky enough to purchase two September 08 futures contracts on soybeans when the contracts were at the lowest price of the day.What is Julie's total profit or loss as of the end of the day?

A) $25.00

B) $50.00

C) $60.00

D) $250.00

E) $260.00

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

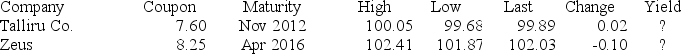

Use the following bond quotes to answer this question:

-The Zeus Company bond pays interest semi-annually.You own six of these bonds.What is the amount you will receive as your next interest payment?

-The Zeus Company bond pays interest semi-annually.You own six of these bonds.What is the amount you will receive as your next interest payment?

A) $76.00

B) $228.00

C) $190.00

D) $247.50

E) $304.00

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money market instruments:

A) tend to be illiquid.

B) are generally sold in small denominations.

C) cannot be resold.

D) may be sold on a discount basis.

E) are quoted in terms of a spread.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

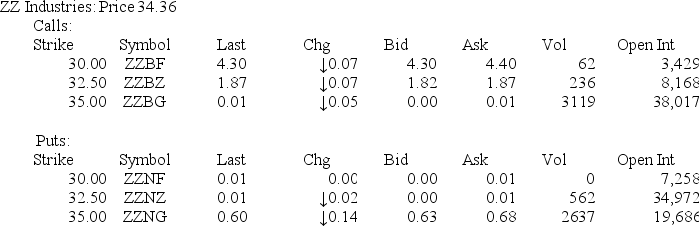

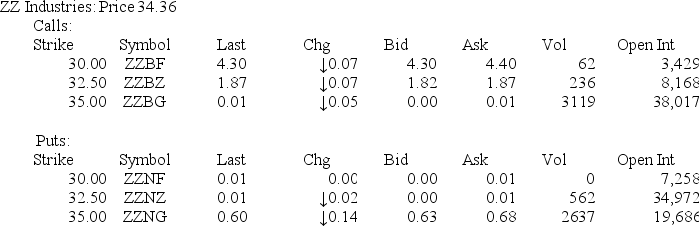

Use these option quotes to answer this question:

-You want the right,but not the obligation,to sell 400 shares of ZZ Industries stock at a price of $32.50 a share.How much will it cost you to establish this option position?

-You want the right,but not the obligation,to sell 400 shares of ZZ Industries stock at a price of $32.50 a share.How much will it cost you to establish this option position?

A) $3.50

B) $4.00

C) $3.60

D) $3.78

E) $3.82

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume a semi-annual coupon bond matures in 3 years,has a face value of $1,000,a current market price of $989,and a 5 percent coupon.Which one of the following statements is correct concerning this bond?

A) The current coupon rate is greater than 5 percent.

B) The bond is a money market instrument.

C) The bond will pay less annual interest now than when it was originally issued.

D) The current yield exceeds the coupon rate.

E) The bond will pay semi-annual payments of $50 each.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchased 500 shares of SLG,Inc.stock at a price of $43.70 a share.You then purchased put options on your shares with a strike price of $40.00 and an option premium of $0.90.At expiration,the stock was selling for $47.80 a share.You sold your shares on the option expiration date.What is your net profit or loss your transactions related to SLG,Inc.stock?

A) $1,650

B) $1,250

C) $1,600

D) $2,150

E) $2,300

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchased six put option contracts with a strike price of $30 and a premium of $0.90.At expiration,the stock was selling for $26.80 a share.What is the total net amount you received for your shares,assuming that you disposed of your shares on the expiration date?

A) $17,955

B) $17,460

C) $17,045

D) $17,815

E) $17,160

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use these option quotes to answer this question:

-You own 700 shares of ZZ Industries stock which you purchased for $38.40 a share.You would like to have the right to sell your shares for $35.00 a share.What will be the cost to obtain this right?

-You own 700 shares of ZZ Industries stock which you purchased for $38.40 a share.You would like to have the right to sell your shares for $35.00 a share.What will be the cost to obtain this right?

A) $0.40

B) $0.90

C) $7.00

D) $476.00

E) $900.00

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

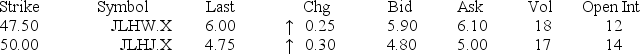

Use these option quotes to answer this question:

-What price will you receive (per underlying share) if you sell the 47.50 call option on JL stock?

-What price will you receive (per underlying share) if you sell the 47.50 call option on JL stock?

A) $4.80

B) $5.00

C) $5.90

D) $6.00

E) $6.10

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Great Lakes Farm agreed this morning to sell General Mills 25,000 bushels of wheat six months from now at a price per bushel of $9.75.This is an example of a:

A) call option.

B) put option.

C) futures contract.

D) money market security.

E) fixed-income security.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

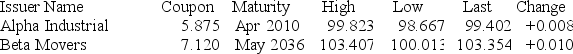

Use the following bond quotes to answer this question:

-What was yesterday's closing price on the Beta Movers bond?

-What was yesterday's closing price on the Beta Movers bond?

A) $1,020.13

B) $1,033.44

C) $1,044.07

D) $1,053.54

E) $1,054.07

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchased three call option contracts with a strike price of $22.50 and an option premium of $0.45.You held the option until the expiration date.On the expiration date,the stock was selling for $21.70 a share.What is the total profit or loss on your option position?

A) -$45

B) $0

C) -$240

D) -$120

E) -$135

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

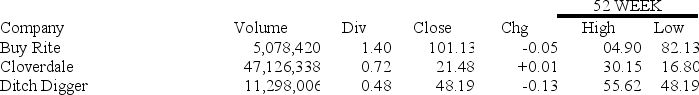

Use the following stock quotes to answer this question:

-What is the current yield on Buy Rite stock?

-What is the current yield on Buy Rite stock?

A) 1.38 percent

B) 2.60 percent

C) 3.55 percent

D) 4.25 percent

E) 5.20 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use these option quotes to answer this question:

-The 47.50 put on a stock is trading at 1.32 bid and 1.37 ask.To buy one option contract,you must pay ________ at the time the contract is purchased.

-The 47.50 put on a stock is trading at 1.32 bid and 1.37 ask.To buy one option contract,you must pay ________ at the time the contract is purchased.

A) $1.32

B) $132.00

C) $137.00

D) $4,613.00

E) $4,882.00

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following sentences is correct concerning fixed-income securities?

A) The coupon rate on a fixed-income security is equal to the current yield.

B) The price of a fixed-income security is inversely related to the current yield.

C) Fixed-income securities are default free.

D) Fixed-income securities tend to be more liquid than money market securities.

E) Fixed-income securities include all debt instruments issued by the U.S. government.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of money per share that will be received when a put option on stock is exercised is called the ________ price.

A) market

B) stock

C) strike

D) future

E) obligated

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 94

Related Exams