B) False

Correct Answer

verified

Correct Answer

verified

Essay

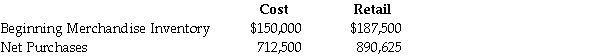

Octave Company had the following cost and retail pricing on its merchandise inventory.  The net sales revenue for the time period was $65,000. Compute the estimated cost of ending merchandise inventory by the retail method.

The net sales revenue for the time period was $65,000. Compute the estimated cost of ending merchandise inventory by the retail method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased 100 units for $20 each on January 31. It purchased 100 units for $30 on February 28. It sold 150 units for $45 each from March 1 through December If the company uses the last-in, first-out inventory costing method, what is the amount of cost of goods sold on the income statement for the year ending December 31? (Assume that the company uses a perpetual inventory system.)

A) $4,000

B) $3,000

C) $2,000

D) $5,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct formula to calculate average merchandise inventory?

A) Average merchandise inventory = (Beginning merchandise inventory - Ending merchandise inventory) ÷ 2

B) Average merchandise inventory = (Beginning merchandise inventory × Ending merchandise inventory) ÷ 2

C) Average merchandise inventory = (Beginning merchandise inventory ÷ Ending merchandise inventory) ÷ 2

D) Average merchandise inventory = (Beginning merchandise inventory + Ending merchandise inventory) ÷ 2

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The consistency principle states that a business should use the same accounting methods from period to period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the current replacement cost of inventory is less than its historical cost, the business must adjust the inventory value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A company is uncertain whether a complex transaction should be recorded as an asset or an expense. Under the conservatism principle, they should choose to treat it as an asset.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Inventory turnover measures the number of times a company sells its average level of merchandise inventory during a period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A high rate of inventory turnover indicates difficulty in selling inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When inventory costs are declining, which of the following inventory costing methods will result in the highest cost of goods sold?

A) First-in, first-out

B) Last-in, first-out

C) Weighted-average

D) Specific identification

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Best Deals has six CD players in ending merchandise inventory on December 31. The players were purchased in November for $165. The price lists from suppliers indicate the current replacement cost of a CD player to be $162. What would be the amount reported as Inventory on the balance sheet?

A) $972

B) $990

C) $1,800

D) $1,890

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The materiality concept states that a company must:

A) report only such information that enhances the financial position of the company.

B) perform strictly proper accounting only for significant items.

C) report enough information for outsiders to make knowledgeable decisions about the company.

D) use the same accounting methods and procedures from period to period.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The consistency principle states that businesses should report the same amount of ending merchandise inventory from period to period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory turnover measures:

A) the days' sales in inventory ratio.

B) how rapidly merchandise inventory is purchased.

C) how rapidly merchandise inventory is sold.

D) the time period for inventory become obsolete (worthless) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Gross profit is calculated by dividing sales revenue by cost of goods sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sandra Company had 200 units of inventory on hand at the end of the year. These were recorded at a cost of $12 each using the last-in, first-out (LIFO) method. The current replacement cost is $10 per unit. The selling price charged by Sandra Company for each finished product is $15. In order to record the adjusting entry needed under the lower-of-cost-or-market rule, the Cost of Goods Sold will be:

A) debited by $2,000.

B) credited by $2,000.

C) debited by $400.

D) credited by $400.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Ending inventory equals the cost of goods available for sale less beginning inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following inventory valuation methods should be used for unique or high dollar items?

A) First-in, first-out

B) Last-in, first-out

C) Weighted-average

D) Specific identification

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Given the same purchase and sales data, the three major costing methods for inventory will result in three different amounts for cost of goods sold. Assume the cost of inventory is rising.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

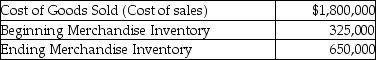

Thomas Company provided the following particulars for year 2015:  Calculate Thomas's inventory turnover ratio for the year. (Round your answer to two decimal places.)

Calculate Thomas's inventory turnover ratio for the year. (Round your answer to two decimal places.)

A) 5.53 times per year

B) 3.69 times per year

C) 2.76 times per year

D) 1.85 times per year

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 155

Related Exams