A) a separate schedule

B) the cash flows from financing activities section

C) the cash flows from investing activities section

D) the cash flows from operating activities section

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information is available from the current period financial statements: The net cash flow from operating activities using the indirect method is

A) $166,000

B) $184,000

C) $110,000

D) $240,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The declaration and issuance of a stock dividend would be reported on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Matching

For each of the following, identify whether it would be disclosed as an activity on the statement of cash flows under the indirect method.

Correct Answer

True/False

A building with a cost of $153,000 and accumulated depreciation of $42,000 was sold for an $11,000 gain. When using the indirect method, the cash generated from this investing activity was $121,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In determining the cash flows from operating activities for the statement of cash flows by the indirect method, the depreciation expense for the period is added to the net income for the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On the statement of cash flows, the cash flows from financing activities section would include all of the following except

A) receipts from the sale of bonds payable

B) payments for dividends

C) payments for purchase of treasury stock

D) payments of interest on bonds payable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following can be found on the statement of cash flows?

A) cash flows from operating activities

B) total assets

C) total changes in stockholders' equity

D) changes in retained earnings

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For each of the following activities that may take place during the accounting period, indicate the effect (a-g) on the statement of cash flows prepared using the indirect method. Choices may be selected as the answer for more than one question. -Sale of land

A) Increase cash from operating activities

B) Decrease cash from operating activities

C) Increase cash from investing activities

D) Decrease cash from investing activities

E) Increase cash from financing activities

F) Decrease cash from financing activities

G) Noncash investing and financing activity

I) A) and E)

Correct Answer

verified

Correct Answer

verified

Essay

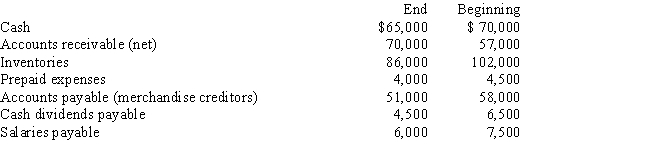

The net income reported on an income statement for the current year was $63,000. Depreciation recorded on fixed assets for the year was $24,000. Balances of the current asset and current liability accounts at the end and beginning of the year are listed below. Prepare the Cash Flows from Operating Activities section of the statement of cash flows using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following selected account balances appeared on the financial statements of the Washington Company. Use these balances to answer the questions that follow. The Washington Company uses the direct method to calculate net cash flow from operating activities. Assume that all accounts payable are owed to merchandise suppliers. -Income tax expense was $175,000 for the year. Income tax payable was $30,000 and $40,000 at the beginning and end of the year, respectively. Cash payments for income tax reported on the statement of cash flows using the direct method is

A) $175,000

B) $165,000

C) $205,000

D) $215,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of merchandise sold during the year was $50,000. Merchandise inventories were $12,500 and $10,500 at the beginning and end of the year, respectively. Accounts payable (all owed to merchandise suppliers) were $6,000 and $5,000 at the beginning and end of the year, respectively. Using the direct method of reporting cash flows from operating activities, cash payments for merchandise total

A) $49,000

B) $47,000

C) $51,000

D) $53,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

To determine cash payments for income taxes for the statement of cash flows using the direct method, an increase in income taxes payable is added to the income tax expense.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the section of the statement of cash flows (a-d) where each of the following items would be reported. -Purchase of the stock of another company as investment

A) Operating activities

B) Financing activities

C) Investing activities

D) Schedule of noncash financing and investing

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

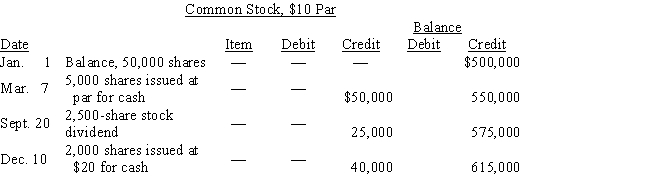

On the basis of the details of the common stock account presented below, calculate the total amount to be recorded in financing section of the statement of cash flows. Assume any stock issues were at par.

Indicate whether the amount results in an increase or decrease in cash.

Correct Answer

verified

Correct Answer

verified

True/False

The statement of cash flows is an optional financial statement.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Fortune Corporation's comparative balance sheet for current assets and liabilities was as follows: Adjust Year 2 net income of $65,000 for changes in operating assets and liabilities to arrive at cash flows from operating activities using the indirect method.

Correct Answer

verified

Correct Answer

verified

True/False

Cash paid to acquire treasury stock should be shown on the statement of cash flows under investing activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The manner of reporting cash flows from investing and financing activities will be different under the direct method as compared to the indirect method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash paid to purchase long-term investments would be reported in the statement of cash flows in

A) the cash flows from operating activities section

B) the cash flows from financing activities section

C) the cash flows from investing activities section

D) a separate schedule

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 195

Related Exams