A) $72,000.

B) $87,500.

C) $90,000.

D) $100,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

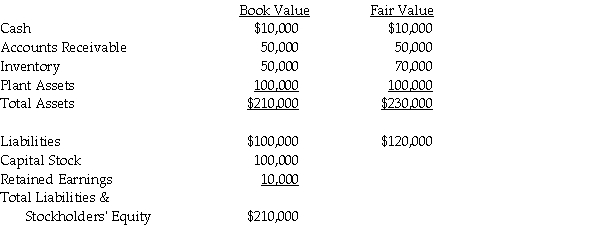

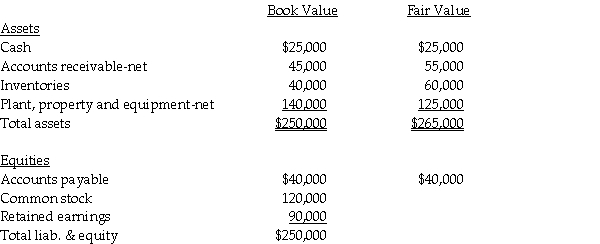

On January 1, 2011, Brody Company acquired an 80% interest in Kristin Company for $240,000 cash.On January 1, 2011, Kristin Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.Both companies use the entity theory.

Required:

1.What is the goodwill associated with Kristin Company on January 1, 2011?

2.Prepare the journal entry(ies)on Kristin's books on January 1, 2011.

3.Prepare the journal entry(ies)on Brody's books on January 1, 2011.

4.Prepare the elimination entry(ies)on the consolidating working papers on January 1, 2011.

Push-down accounting is used for the acquisition.Both companies use the entity theory.

Required:

1.What is the goodwill associated with Kristin Company on January 1, 2011?

2.Prepare the journal entry(ies)on Kristin's books on January 1, 2011.

3.Prepare the journal entry(ies)on Brody's books on January 1, 2011.

4.Prepare the elimination entry(ies)on the consolidating working papers on January 1, 2011.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer the question(s) below.

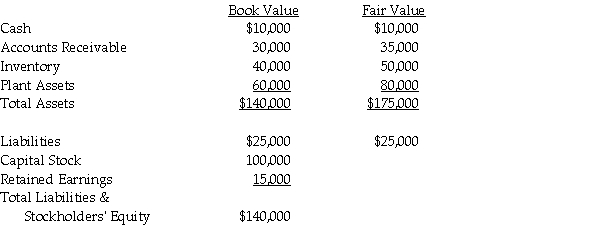

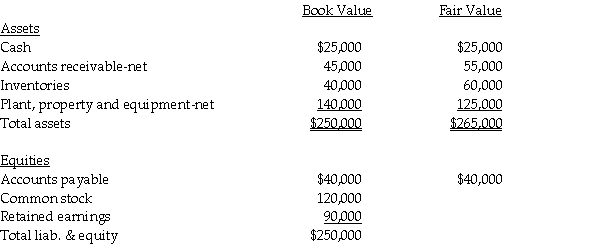

On January 1, 2011, Penelope Company acquired a 90% interest in Leah Company for $180,000 cash. On January 1, 2011, Leah Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

-Assume the parent company theory is used.On January 2, 2011, Leah Company will report Goodwill of ________ and Accounts Receivable of ________ on Leah's balance sheet.

Push-down accounting is used for the acquisition.

-Assume the parent company theory is used.On January 2, 2011, Leah Company will report Goodwill of ________ and Accounts Receivable of ________ on Leah's balance sheet.

A) $27,000; $30,000

B) $27,000; $35,000

C) $30,000; $30,000

D) $45,000; $34,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume Paris's inventory account had a book value of $40,000 and a fair value of $44,000 on January 1, 2011.Using the parent company theory, what was the amount reported on the consolidated balance sheet for inventories on January 1, 2011?

A) $65,000

B) $66,000

C) $69,000

D) $70,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

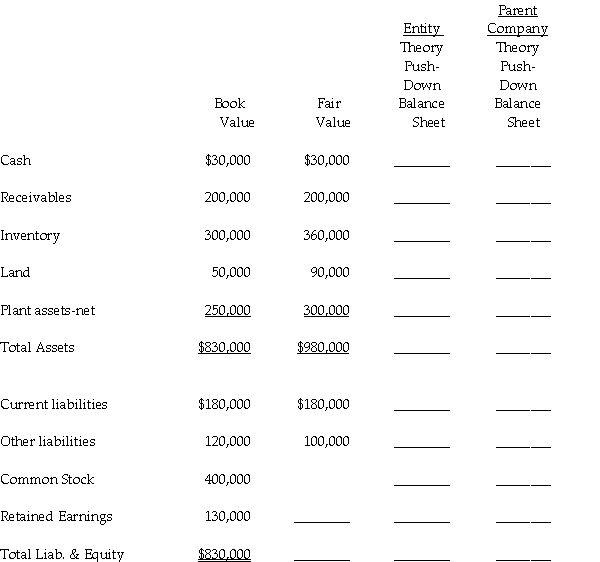

Partridge Corporation purchased an 80% interest in Sandy Corporation for $840,000 on January 1, 2011.Sandy's balance sheet book values and accompanying fair values on this date are shown below.

Required:

Complete the push-down columns of Sandy Corporation's restructured balance sheet using entity theory and parent company theory.

Required:

Complete the push-down columns of Sandy Corporation's restructured balance sheet using entity theory and parent company theory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer the question(s) below. Pascoe Corporation paid $450,000 for a 90% interest in Sarabet Corporation on January 1, 2011, when Sarabet's stockholders' equity consisted of $250,000 Common Stock and $50,000 Retained Earnings. The book values and fair values of Sarabet's assets and liabilities were equal when Pascoe acquired its interest. The separate net incomes (excluding investment income) of Pascoe and Sarabet for 2011 were $600,000 and $100,000, respectively. Dividends declared and paid during 2011 were $250,000 for Pascoe and $50,000 for Sarabet. Pascoe uses the entity theory in consolidating its financial statements with those of Sarabet. -Goodwill was reported in the December 31, 2011 consolidated balance sheet at

A) $170,000.

B) $180,000.

C) $200,000.

D) $210,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Patane Corporation acquired 80% of the outstanding voting common stock of Sanlon Corporation on January 1, 2011, for $500,000.Sanlon Corporation's stockholders' equity at this date consisted of $250,000 in Capital Stock and $100,000 in Retained Earnings.The fair value of Sanlon's assets was equal to the book value of the assets except for land with a fair value $40,000 greater than its book value, and marketable securities with a fair value $50,000 greater than its book value.Sanlon also had a valuable patent with a fair value of $25,000 and a book value of zero because its development costs were expensed as incurred.The fair value of Sanlon's liabilities is $10,000 higher than the $40,000 book value. Required: Calculate the amount of goodwill under the parent company and entity theories of consolidation.

Correct Answer

verified

Correct Answer

verified

Essay

On January 1, 2011, Penny Company acquired a 90% interest in Lampire Company for $180,000 cash.On January 1, 2011, Lampire Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Required:

1.Assume both companies use the entity theory.Record the push-down adjustment on Lampire's separate books on January 1, 2011.

2.Assume both companies use the parent company theory.Record the push-down adjustment on Lampire's separate books on January 1, 2011.

Push-down accounting is used for the acquisition.

Required:

1.Assume both companies use the entity theory.Record the push-down adjustment on Lampire's separate books on January 1, 2011.

2.Assume both companies use the parent company theory.Record the push-down adjustment on Lampire's separate books on January 1, 2011.

Correct Answer

verified

11ea87ae_613d_f143_8726_c1f9329629ce_TB2662_00

Correct Answer

verified

Multiple Choice

Noncontrolling interest share is viewed as an expense under ________ theory.

A) parent company

B) entity

C) contemporary

D) joint venture

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Entities other than the primary beneficiary account for their investment in a variable interest entity using the

A) cost method.

B) equity method.

C) cost or equity methods.

D) consolidated method.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

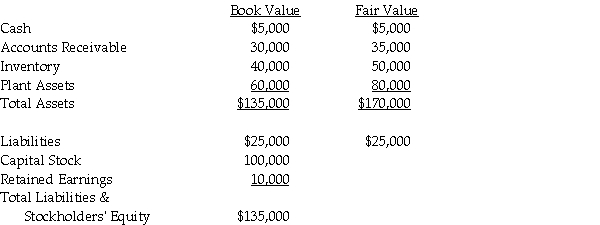

Johnsen Corporation paid $225,000 for a 70% interest in Jonas Corporation on January 1, 2011.On that date, Jonas's balance sheet accounts, at book value and fair value, were as follows:

Required:

1.Prepare the journal entry necessary on January 1, 2011 on Jonas Corporation's books.Both companies use push-down accounting and the entity theory.

2.Prepare the balance sheet for Jonas Corporation immediately after the acquisition on January 1, 2011.

Required:

1.Prepare the journal entry necessary on January 1, 2011 on Jonas Corporation's books.Both companies use push-down accounting and the entity theory.

2.Prepare the balance sheet for Jonas Corporation immediately after the acquisition on January 1, 2011.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information to answer the question(s) below. Pascoe Corporation paid $450,000 for a 90% interest in Sarabet Corporation on January 1, 2011, when Sarabet's stockholders' equity consisted of $250,000 Common Stock and $50,000 Retained Earnings. The book values and fair values of Sarabet's assets and liabilities were equal when Pascoe acquired its interest. The separate net incomes (excluding investment income) of Pascoe and Sarabet for 2011 were $600,000 and $100,000, respectively. Dividends declared and paid during 2011 were $250,000 for Pascoe and $50,000 for Sarabet. Pascoe uses the entity theory in consolidating its financial statements with those of Sarabet. -Noncontrolling interest share was reported in the 2011 consolidated income statement at

A) $5,000.

B) $6,000.

C) $8,000.

D) $10,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under push-down accounting, the ________ of the acquired subsidiary's assets and liabilities are reported on the financial statements of the ________.

A) book value; subsidiary

B) book value; parent

C) fair value; subsidiary

D) present value; parent

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

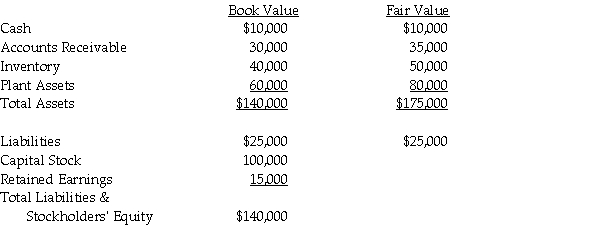

Pascal Corporation paid $225,000 for a 70% interest in Sank Corporation on January 1, 2011.On that date, Sank's balance sheet accounts, at book value and fair value, were as follows:

Both companies use the parent company theory.Push-down accounting is used for the acquisition.

Required:

1.Prepare the journal entry on January 1, 2011 on Sank Corporation's books.

2.Prepare a balance sheet for Sank Corporation immediately after the acquisition on January 1, 2011.

Both companies use the parent company theory.Push-down accounting is used for the acquisition.

Required:

1.Prepare the journal entry on January 1, 2011 on Sank Corporation's books.

2.Prepare a balance sheet for Sank Corporation immediately after the acquisition on January 1, 2011.

Correct Answer

verified

Correct Answer

verified

Essay

On January 1, 2011, Jeff Company acquired a 90% interest in Marian Company for $198,000 cash.On January 1, 2011, Marian Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Required:

1.Assume both companies use the entity theory.Prepare the elimination entry(ies)on consolidating work papers on January 1, 2011.

2.Assume both companies use the parent company theory.Prepare the elimination entry(ies)on consolidating work papers on January 1, 2011.

Push-down accounting is used for the acquisition.

Required:

1.Assume both companies use the entity theory.Prepare the elimination entry(ies)on consolidating work papers on January 1, 2011.

2.Assume both companies use the parent company theory.Prepare the elimination entry(ies)on consolidating work papers on January 1, 2011.

Correct Answer

verified

Correct Answer

verified

Essay

On July 1, 2010, Parslow Corporation acquired a 75% interest in Sanderson Corporation for $150,000.Sanderson's net assets on this date had a book value of $140,000 and a fair value of $160,000.The excess of fair value over book value at acquisition was due to understated plant assets with a remaining useful life of five years from July 1, 2010.Separate net incomes (excluding investment income)of Parslow and Sanderson for 2011 were $400,000 and $20,000, respectively. Required: 1.Compute goodwill at July 1, 2010 under the parent company theory and the entity theory. 2.Determine consolidated net income and noncontrolling interest share for 2011 under the parent company theory and the entity theory.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With regard to a variable interest entity (VIE) , Ann Company may meet the following two conditions: Condition I Ann Company has the power to direct VIE activities that significantly impact VIE's economic performance. Condition II Ann Company has an obligation to absorb losses and/or a right to receive significant benefits from the VIE. Ann Company must consolidate a VIE if

A) Condition I is met only.

B) Condition II is met only.

C) either Condition I or Condition II is met.

D) both Condition I and Condition II are met.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A parent company acquired 100% of the outstanding common stock of another corporation.The parent is going to use push-down accounting.The fair market value of each of the acquired corporation's assets is lower than its respective book value.The fair market value of each of the acquired corporation's liabilities is higher than its respective book value.The acquired corporation has a deficit in the Retained Earnings account.Which one of the following statements is correct?

A) The push-down capital account will have a credit balance after this transaction is posted.

B) The push-down capital account will have a debit balance after this transaction is posted.

C) The push-down capital account will have either a debit or a credit balance depending upon whether the asset adjustments exceed the liability adjustments, or vice versa.

D) Subsidiary Retained Earnings will have a deficit balance after this transaction is posted.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the entity theory, a consolidated balance sheet prepared immediately after the business combination will show noncontrolling interest of

A) $5,000.

B) $7,500.

C) $9,000.

D) $10,000.

F) A) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Anthony and Cleopatra create a joint venture to distribute artifacts.Anthony contributes 70% and Cleopatra 30% of the cash for assets purchased from Tomb Company.How would Anthony report information about Cleopatra on Anthony's financial statements?

A) Not at all

B) In a footnote

C) As a liability

D) As a noncontrolling interest

F) All of the above

Correct Answer

verified

D

Correct Answer

verified

Showing 1 - 20 of 41

Related Exams