A) £0.5799

B) £0.5822

C) £0.6105

D) £0.6623

E) £0.6644

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the spot exchange rate for the Canadian dollar is C$1.28 and the six-month forward rate is C$1.33.The U.S.dollar is selling at a _____ relative to the Canadian dollar and the U.S.dollar is expected to _____ relative to the Canadian dollar.

A) discount;appreciate

B) discount;depreciate

C) premium;appreciate

D) premium;depreciate

E) premium;remain constant

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Relative purchasing power parity:

A) states that identical items should cost the same regardless of the currency used to make the purchase.

B) relates differences in inflation rates to differences in exchange rates.

C) compares the real rate of return to the nominal rate of return.

D) explains the differences in real rates across national boundaries.

E) relates future exchange rates to current spot rates.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the current spot rate is C$1.1875 and the one-year forward rate is C$1.1724.The nominal risk-free rate in Canada is 4 percent while it is 3 percent in the U.S.Using covered interest arbitrage you can earn an extra _____ profit over that which you would earn if you invested $1 in the U.S.

A) $0.018

B) $0.023

C) $0.029

D) $0.031

E) $0.035

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Long-run exposure to exchange rate risk relates to:

A) daily variations in exchange rates.

B) variances between spot and future rates.

C) unexpected changes in relative economic conditions.

D) differences between future spot rates and related forward rates.

E) accounting gains and losses created by fluctuating exchange rates.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The home currency approach:

A) discounts all of a project's foreign cash flows using the current spot rate.

B) employs uncovered interest parity to project future exchange rates.

C) computes the net present value (NPV) of a project in the foreign currency and then converts that NPV into U.S.dollars.

D) utilizes the international Fisher effect to compute the NPV of foreign cash flows in the foreign currency.

E) utilizes the international Fisher effect to compute the relevant exchange rates needed to compute the NPV of foreign cash flows in U.S.dollars.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is the risk that a firm faces when it opens a facility in a foreign country,given that the exchange rate between the firm's home country and this foreign country fluctuates over time?

A) international risk

B) diversifiable risk

C) purchasing power risk

D) exchange rate risk

E) political risk

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

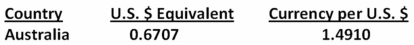

You are planning a trip to Australia.Your hotel will cost you A$145 per night for seven nights.You expect to spend another A$2,800 for meals,tours,souvenirs,and so forth.How much will this trip cost you in U.S.dollars given the following exchange rates?

A) $2,559

B) $2,604

C) $2,631

D) $5,452

E) $5,688

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the euro is selling in the spot market for $1.33.Simultaneously,in the 3-month forward market the euro is selling for $1.35.Which one of the following statements correctly describes this situation?

A) The spot market is out of equilibrium.

B) The forward market is out of equilibrium.

C) The dollar is selling at a premium relative to the euro.

D) The euro is selling at a premium relative to the dollar.

E) The euro is expected to depreciate in value.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You would like to purchase a security that is issued by the British government.Which one of the following should you purchase?

A) Samurai bond

B) kronor

C) Euro

D) LIBOR

E) gilt

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the spot rate for the British pound currently is £0.6211 per $1.Also assume the one-year forward rate is £0.6347 per $1.A risk-free asset in the U.S.is currently earning 3.4 percent.If interest rate parity holds,what rate can you earn on a one-year risk-free British security?

A) 1.18 percent

B) 1.57 percent

C) 3.67 percent

D) 5.66 percent

E) 5.92 percent

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

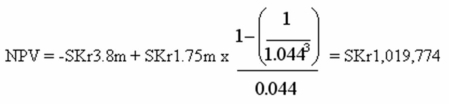

Suppose the current spot rate for the Norwegian kroner is $1 = NKr6.6869.The expected inflation rate in Norway is 6 percent and in the U.S.it is 3.1 percent.A risk-free asset in the U.S.is yielding 4 percent.What risk-free rate of return should you expect on a Norwegian security?

A) 3.5 percent

B) 4.0 percent

C) 4.5 percent

D) 5.0 percent

E) 6.9 percent

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-You are analyzing a project with an initial cost of £48,000.The project is expected to return £11,000 the first year,£36,000 the second year and £38,000 the third and final year.There is no salvage value.The current spot rate is £0.6211.The nominal return relevant to the project is 12 percent in the U.S.The nominal risk-free rate in the U.S.is 4 percent while it is 5 percent in the U.K.Assume that uncovered interest rate parity exists.What is the net present value of this project in U.S.dollars?

-You are analyzing a project with an initial cost of £48,000.The project is expected to return £11,000 the first year,£36,000 the second year and £38,000 the third and final year.There is no salvage value.The current spot rate is £0.6211.The nominal return relevant to the project is 12 percent in the U.S.The nominal risk-free rate in the U.S.is 4 percent while it is 5 percent in the U.K.Assume that uncovered interest rate parity exists.What is the net present value of this project in U.S.dollars?

A) $23,611

B) $25,938

C) $26,930

D) $29,639

E) $30,796

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of one Euro expressed in U.S.dollars is referred to as a(n) :

A) ADR rate.

B) cross inflation rate.

C) depository rate.

D) exchange rate.

E) foreign interest rate.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the spot exchange rate for the Hungarian forint is HUF 215.Also assume the inflation rate in the United States is 4 percent per year while it is 9.5 percent in Hungary.What is the expected exchange rate 5 years from now?

A) 269

B) 276

C) 281

D) 294

E) 299

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following formulas expresses the absolute purchasing power parity relationship between the U.S.dollar and the British pound?

A) S0 = PUK × PUS

B) PUS = Ft × PUK

C) PUK = S0 × PUS

D) Ft = PUS × PUK

E) S0 × Ft = PUK × PUS

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

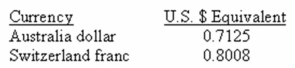

Based on the information below,what is the cross-rate for Australian dollars in terms of Swiss francs?

A) 0.5607

B) 0.7219

C) 0.8897

D) 1.1437

E) 1.2834

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the spot rate for the Japanese yen currently is ¥99.31 per $1 and the one-year forward rate is ¥97.62 per $1.A risk-free asset in Japan is currently earning 2.5 percent.If interest rate parity holds,approximately what rate can you earn on a one-year risk-free U.S.security?

A) 1.63 percent

B) 2.11 percent

C) 4.20 percent

D) 4.96 percent

E) 5.01 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following states that the current forward rate is an unbiased predictor of the future spot exchange rate?

A) unbiased forward rates

B) uncovered interest rate parity

C) international Fisher effect

D) purchasing power parity

E) interest rate parity

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the spot market,$1 is currently equal to £0.6211.Assume the expected inflation rate in the U.K.is 4.2 percent while it is 3.1 percent in the U.S.What is the expected exchange rate one year from now if relative purchasing power parity exists?

A) £0.6161

B) £0.6178

C) £0.6239

D) £0.6279

E) £0.6291

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 99

Related Exams