A) Cost drivers.

B) Activity cost pools.

C) Activity bases.

D) Indirect cost centers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the above data. If Riverview applies overhead using a predetermined rate based on machine-hours, what amount of overhead will be assigned to a unit of output which requires 0.5 machine hours and 0.25 labor hours to complete?

A) $12.00.

B) $16.00.

C) $20.00.

D) Some other amount.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Job order costing is appropriate for businesses that produce mass quantities of identical units using the same amount of direct materials, direct labor, and manufacturing overhead.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What are the total manufacturing overhead costs allocated to the Baby Swings for the current month?

A) $69,837.

B) $102,873.

C) $37,290.

D) $210,000.

F) None of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A job cost sheet usually contains a record of each of the following except:

A) The cost of direct materials charged to a particular job.

B) The overhead costs actually incurred on a particular job.

C) The cost of direct labor charged to a particular job.

D) The overhead cost applied to a particular job.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

What is the work in process inventory at October 31? $___________

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead is not:

A) A product cost.

B) An indirect cost.

C) A manufacturing cost.

D) A period cost.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A predetermined overhead application rate:

A) Is used in a job order cost system but cannot be used in a process cost system.

B) Can be determined by dividing budgeted direct labor cost by the budgeted factory overhead costs.

C) Is not generally accepted for financial reporting purposes.

D) Tends to avoid wide variations in per-unit overhead costs because of short-run changes in volume.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a job is completed:

A) Cost of goods sold is debited.

B) Work-in-process inventory is debited.

C) Finished goods inventory is credited.

D) None of the above.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Activity-based costing tracks cost to the activities that consume resources.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

A debit balance in the Manufacturing Overhead account at the end of the period indicates that overhead has been under-applied to jobs.

B) False

Correct Answer

verified

Correct Answer

verified

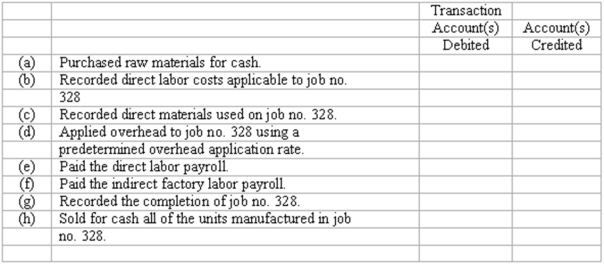

Essay

Job order cost system-journal entries

Shown below is a partial list of accounts for Miles Mfg. Co., followed by a list of transactions. Indicate the accounts that would be debited and credited in recording each transaction by placing the appropriate account numbers in the space provided. The company uses a job order cost accounting system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The year-end balance in the Materials Inventory controlling account is equal to:

A) The total of the various materials subsidiary ledger accounts (the materials on hand at the end of the period.)

B) The total amount of materials requisitioned during the period.

C) The total amount of materials purchased during the period.

D) The amount of materials debited to the Work-in-Process Inventory account during the period.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A job cost sheet should:

A) Contain information that summarizes all jobs finished.

B) Contain information on each individual job in process.

C) Contain only the direct costs of a particular job.

D) Only be used for jobs that have been completed.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The account Finished Goods:

A) Consists of completed goods that have not yet been sold.

B) Consists of goods being manufactured that are incomplete.

C) Consists of materials to be used in the production process.

D) Consists of the cost of new materials used, labor but not overhead.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true about activity-based costing?

A) Only one activity should be used for a company.

B) Many different activity bases are used in applying overhead.

C) There can only be one cost driver.

D) Direct materials and direct labor are applied to work-in-process based upon cost drivers.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Metalworks employs 3 assembly workers that, on average, each work 40 hours per week and earn $9 per hour. During the current accounting period, Job #543 consumed 77 hours of direct labor totaling $693. 77 direct labor hours x $9 = $693.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of direct materials cost charged to completed jobs during March was:

A) $20,000.

B) $50,000.

C) $30,000.

D) Some other amount.

F) B) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The use of activity-based costing is most appropriate for:

A) Firms that manufacture multiple product lines.

B) Firms that have very low manufacturing overhead costs relative to other costs of production.

C) Firms with high levels of production activity.

D) Firms that account separately for product and period costs.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An overhead application rate is computed by dividing the estimated overhead costs by the expected amount of units in the activity base.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 116

Related Exams