A) Greater the resulting increase in the price level, the greater the rate of growth of output, and the greater the unemployment rate

B) Greater the resulting increase in the price level, the lower the rate of growth of output, and the greater the unemployment rate

C) Less the resulting increase in the price level, the lower the rate of growth of output, and the greater the unemployment rate

D) Greater the resulting increase in the price level, the greater the rate of growth of output, and the lower the unemployment rate

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The long-run Phillips Curve is vertical at:

A) Price level of 100

B) The natural rate of unemployment

C) The natural rate of inflation

D) Potential GDP

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Supply-side economists contend that the system of taxation in the United States:

A) Creates incentives to save and invest

B) Creates dis-incentives to work

C) Generates maximum tax revenue

D) Reduces the effects of cost-push inflation

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Romer and Romer 2010 paper in the American Economic Review found that tax changes that are made to promote long-run growth or to reduce an inherited budget deficit tend to result in:

A) A strong positive relationship between taxes and output GDP

B) A weak positive relationship between taxes and output GDP

C) An uncertain correlation between taxes and output GDP

D) A strong negative relationship between taxes and output GDP

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the Phillips Curve, when the actual rate of inflation is greater than the expected rate, the unemployment rate will:

A) Rise temporarily, but decreases in nominal wages will bring the expected and actual rates of inflation into balance

B) Rise temporarily, but increases in nominal wages will bring the expected and actual rates of inflation into balance

C) Fall temporarily, but increases in nominal wages will bring the expected and actual rates of inflation into balance

D) Fall temporarily, but decreases in nominal wages will bring the actual and expected rates of inflation into balance

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

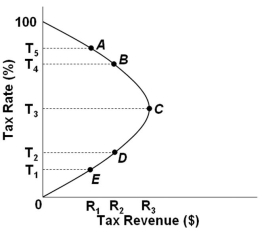

One central idea in supply-side economics concerning budget deficits is illustrated by the:

A) Production possibilities curve

B) Aggregate supply curve

C) The Laffer Curve

D) The Phillips Curve

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the Laffer Curve above. An increase in the tax rate from T2 to T3 would:

Refer to the Laffer Curve above. An increase in the tax rate from T2 to T3 would:

A) Decrease tax revenues and support the views of supply-side economists

B) Increase tax revenues and support the views of supply-side economists

C) Increase tax revenues and support the views of mainstream economists

D) Decrease tax revenues and support the views of mainstream economists

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The Laffer Curve indicates that lower tax rates will increase output.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The automatic adjustment mechanism that makes the economy move towards the long-run Phillips Curve is:

A) Expansionary fiscal or monetary policy

B) Inflation expectations and wage adjustments

C) Contractionary fiscal or monetary policy

D) Increases in productivity over time

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A senator states: "We need to cut taxes in order to increase incentives to work and produce, so that we can pull the nation out of this economic slump." A mainstream economist who is a critic of this policy would likely reply that:

A) Rather than cutting taxes there should be a decrease in government spending to address the problem

B) Rather than cutting taxes, monetary policy should become tighter to control the inflation rate

C) Increasing government spending is a surer way to increase production and pull the nation out of this economic slump

D) Cutting taxes will only reduce output further, and aggravate the situation

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

According to the simple extended AD-AS model, if the economy is in a recession, prices and nominal wages will eventually fall, and the short-run aggregate supply curve increases, so that real output returns to its full-employment level in the long run.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the context of the Phillips curve, stagflation can only be understood as a rightward shift of the curve.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adverse aggregate supply shocks would result in:

A) A lower rate of inflation and a higher rate of unemployment

B) A higher rate of inflation and a lower rate of unemployment

C) A lower rate of inflation and a lower rate of unemployment

D) A higher rate of inflation and a higher rate of unemployment

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The short-run aggregate supply curve:

A) Is vertical and the long-run aggregate supply curve is vertical

B) Slopes upward and the long-run aggregate supply curve also slopes upward

C) Slopes upward, but the long-run aggregate supply curve is horizontal

D) Slopes upward, but the long-run aggregate supply curve is vertical

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What will occur in the short run if there is cost-push inflation and the government adopts a hands-off approach to it?

A) An increase in real output

B) An inflationary spiral

C) Low unemployment and a loss of real output

D) High unemployment and a loss of real output

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the long run, demand-pull inflation leads to:

A) Higher unemployment and higher price level

B) Lower real wages and higher unemployment

C) Lower real output and no change in unemployment

D) Higher price level and no change in real output

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One significant criticism of the major proposition of supply-side economics during the period 1980-1988 was that:

A) The tight monetary policy of the Federal Reserve slowed the growth of the economy and caused a severe recession

B) Major sectors of the economy failed to achieve optimal efficiency from increased regulation by government

C) There was a significant increase in the rate of unemployment over the period

D) Growth in the productive capacity of the economy did not exceed the historical pace

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Supply-side economists contend that aggregate supply is the relevant policy factor in influencing the price level and real output in an economy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Most economists think that:

A) Supply-side effects of a tax cut exceed the demand-side effects

B) Demand-side effects of a tax cut exceed the supply-side effects

C) Demand-side and supply-side effects of a tax cut offset each other

D) There are only supply-side effects from a tax cut

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A rightward shift of the Phillips Curve suggests that:

A) A higher rate of unemployment is associated with each level of inflation rate

B) A lower rate of inflation is associated with each level of unemployment rate

C) The aggregate supply curve has shifted to the right

D) The aggregate demand curve has shifted to the left

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 135

Related Exams