A) December 31st

B) January 31st

C) The last Friday of the last week of June

D) December 15th

E) A tax year can end on any of these days.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The phase "ordinary and necessary" has been defined to mean that an expense must be essential and indispensable to the conduct of a business.A necessary expense is an expense that is helpful or conducive to the business activity.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

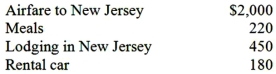

Shelley is employed in Texas and recently attended a two-day business conference in New Jersey.Shelley spent the entire time at the conference and documented her expenditures (described below) .What amount can Shelley deduct as an employee business expense?

A) $2,850

B) $2,740

C) $1,850 if Shelley's AGI is $50,000

D) All of these are deductible if Shelley is reimbursed under an accountable plan.

E) None of the expenses are deductible - only employers can deduct travel expenses.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to deduct a portion of the cost of a business meal which of the following conditions must be met?

A) A client (not a supplier or vendor) must be present at the meal.

B) The taxpayer or an employee must be present at the meal.

C) The meal must occur on the taxpayer's business premises.

D) None of these is a condition for a deduction.The taxpayer or employee must be present for a portion of the cost of the meal to be deductible.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Reasonable in amount means that expenditures can be exorbitant as long as the activity is motivated by profit.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a taxpayer borrows money and invests the loan proceeds in municipal bonds,the interest paid by the taxpayer on the debt will not be deductible.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jones operates an upscale restaurant and he pays experienced cooks $35,000 per year.This year he hired his son as an apprentice cook.Jones agreed to pay his son $40,000 per year.Which of the following is a true statement about this transaction?

A) Jones will be allowed to deduct $40,000 only if his son eventually develops into an expert cook.

B) Jones will be allowed to accrue $40,000 only if he pays his son in cash.

C) Jones will be allowed to deduct $35,000 as compensation and another $5,000 can be deducted as an employee gift.

D) Jones can only deduct $20,000 because an apprentice cook is only worth half as much as an experienced cook.

E) None of thesE.It is likely that Jones will be able to deduct something less than $35,000 as compensation.The remaining compensation will be unreasonable in amount.The compensation will only be deductible in the period in which Jones actually pays his son.Also,gifts are not deductible.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Although expenses associated with illegal activities are not deductible,political contributions can be deducted as long as the donation is not made to a candidate for public office.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

Even a cash method taxpayer must consistently use accounting methods that "clearly reflect income" for tax purposes.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Beth operates a plumbing firm.In August of last year she signed a contract to provide plumbing services for a renovation.Beth began the work that August and finished the work in December of last year.However,Beth didn't bill the client until January of this year and she didn't receive the payment until March when she received payment in full.When should Beth recognize income under the accrual method of accounting?

A) In August of last year

B) In December of last year

C) In January of this year

D) In March of this year

E) In April of this year

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Don operates a taxi business,and this year one of his taxis was damaged in a traffic accident.The taxi was originally purchased for $32,000 and the adjusted basis was $2,000 at the time of the accident.The taxi was repaired at a cost of $2,500 and insurance reimbursed Don $700 of this cost.What is the amount of Don's casualty loss deduction?

A) $1,300

B) $2,500

C) $1,800

D) $2,000

E) Don is not eligible for a casualty loss deduction.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A fiscal tax year can end on the last day of any month other than December.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a true statement?

A) Meals are never deductible as a business expense.

B) An employer can only deduct half of any meals provided to employees.

C) The cost of business meals must be reasonable.

D) A taxpayer can only deduct a meal for a client if business is discussed during the meal.

E) None of these is truE.Employee meals can be fully deductible as compensation and meals merely need to be associated with the conduct of business.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The test for whether an expenditure is reasonable in amount is whether the expenditure was for an "arm's length" amount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dick pays insurance premiums for his employees.What type of insurance premium is not deductible as compensation paid to the employee?

A) Health insurance with benefits payable to the employee.

B) Whole life insurance with benefits payable to the employee's dependents.

C) Group term life insurance with benefits payable to the employee's dependents.

D) Key man life insurance with benefits payable to Dick.

E) All of these are deductible by Dick.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a true statement about a request for a change in accounting method?

A) Some requests are automatically granted.

B) Most requests require the permission of the Commissioner.

C) Many requests require payment of a fee and a good business purpose for the change.

D) Form 3115 is required to be filed with a request for change in accounting method.

E) All of these are truE.All of these reflect true statements about requests for changes in accounting method.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following expenses are completely deductible?

A) $1,000 spent on compensating your brother for a personal expense.

B) $50 spent on meals while traveling on business.

C) $2,000 spent by the employer on reimbursing an employee for entertainment.

D) All of these expenses are fully deductible.

E) None of these expenses can be deducted in full.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A short tax year can end on any day of any month other than December.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Paris operates a talent agency as a sole proprietorship,and this year she incurred the following expenses in operating her talent agency.What is the total deductible amount of these expenditures? $1,000 dinner with a film producer where no business was discussed $500 lunch with sister Nicky where no business was discussed $700 business dinner with a client but Paris forgot to keep any records (oops!) $900 tickets to the opera with a client following a business meeting

A) $450

B) $900

C) $1,100

D) $1,200

E) $800

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

John is a self-employed computer consultant who lives and works in Dallas.John paid for the following activities in conjunction with his business.Which is not deductible in any amount? 1.Dinner with a potential client where the client's business was discussed.2.A trip to Houston to negotiate a contract.3.A seminar in Houston on new developments in the software industry.4.A trip to New York to visit a school chum who is also interested in computers.

A) 1 only.

B) 2 only.

C) 3 only.

D) 4 only.

E) None of thesE.The school chum does not appear to be business related.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 78

Related Exams